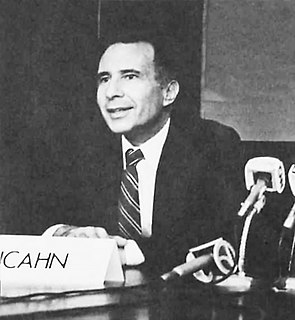

Top 38 Quotes & Sayings by Carl Icahn

Explore popular quotes and sayings by an American businessman Carl Icahn.

Last updated on April 14, 2025.

Now the guy that got to the top, the CEO, would obviously be stupid to have a number two guy who was a lot smarter than he is. So by definition, since he's a survivor and he got to the top and he isn't that brilliant, his number two guy is going to always be a little worse than he is. So, as time goes on, it's anti-Darwinism, the survival of the un- fittest.

In life and business, there are two cardinal sins, the first is to act precipitously without thought, and the second is to not act at all. Unfortunately the board of directors and top management of Times Warner already committed the first sin by merging with AOL, and we believe they are currently in the process of committing the second; now is not a time to move slowly and suffer the paralysis of inaction.