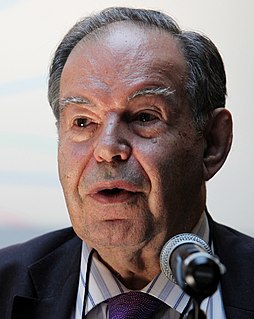

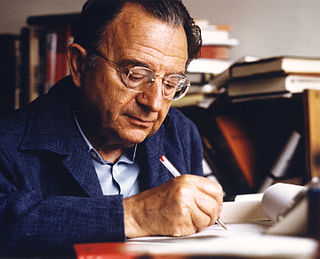

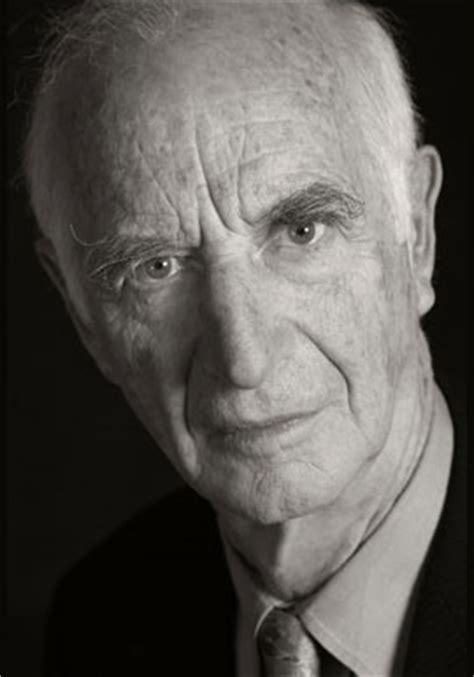

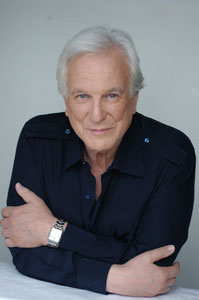

Top 223 Quotes & Sayings by Daniel Kahneman - Page 3

Explore popular quotes and sayings by an Israeli psychologist Daniel Kahneman.

Last updated on April 18, 2025.

However, optimism is highly valued, socially and in the market; people and firms reward the providers of dangerously misleading information more than they reward truth tellers. One of the lessons of the financial crisis that led to the Great Recession is that there are periods in which competition, among experts and among organizations, creates powerful forces that favor a collective blindness to risk and uncertainty.

A general “law of least effort” applies to cognitive as well as physical exertion. The law asserts that if there are several ways of achieving the same goal, people will eventually gravitate to the least demanding course of action. In the economy of action, effort is a cost, and the acquisition of skill is driven by the balance of benefits and costs. Laziness is built deep into our nature.

Finally, the illusions of validity and skill are supported by a powerful professional culture. We know that people can maintain an unshakeable faith in any proposition, however absurd, when they are sustained by a community of like-minded believers. Given the professional culture of the financial community, it is not surprising that large numbers of individuals in that world believe themselves to be among the chosen few who can do what they believe others cannot.

People tend to assess the relative importance of issues by the ease with which they are retrieved from memory—and this is largely determined by the extent of coverage in the media. Frequently mentioned topics populate the mind even as others slip away from awareness. In turn, what the media choose to report corresponds to their view of what is currently on the public’s mind. It is no accident that authoritarian regimes exert substantial pressure on independent media. Because public interest is most easily aroused by dramatic events and by celebrities, media feeding frenzies are common

To know whether you can trust a particular intuitive judgment, there are two questions you should ask: Is the environment in which the judgment is made sufficiently regular to enable predictions from the available evidence? The answer is yes for diagnosticians, no for stock pickers. Do the professionals have an adequate opportunity to learn the cues and the regularities? The answer here depends on the professionals' experience and on the quality and speed with which they discover their mistakes.

I have always believed that scientific research is another domain where a form of optimism is essential to success: I have yet to meet a successful scientist who lacks the ability to exaggerate the importance of what he or she is doing, and I believe that someone who lacks a delusional sense of significance will wilt in the face of repeated experiences of multiple small failures and rare successes, the fate of most researchers.