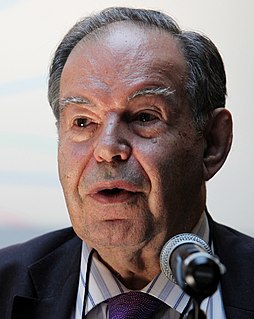

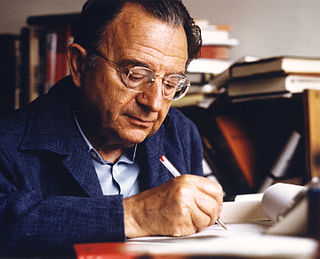

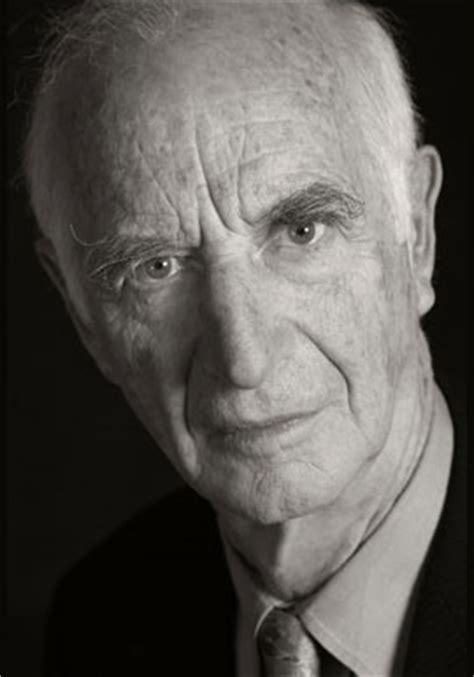

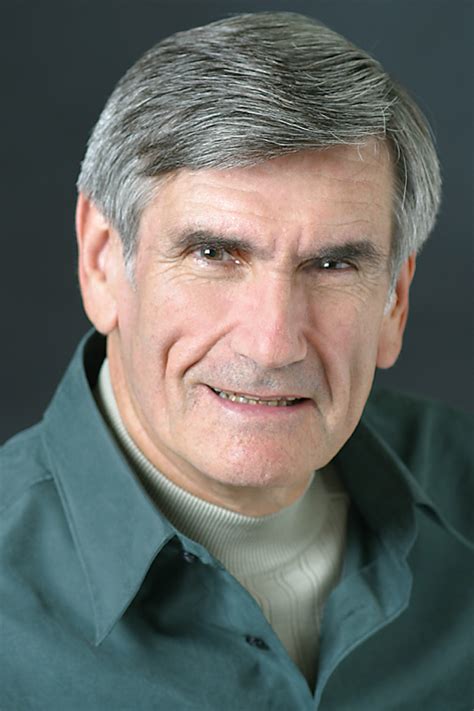

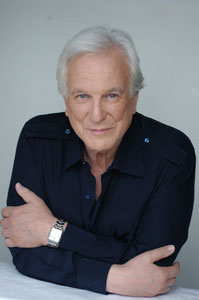

Top 223 Quotes & Sayings by Daniel Kahneman - Page 4

Explore popular quotes and sayings by an Israeli psychologist Daniel Kahneman.

Last updated on December 11, 2024.

We were required to predict a soldier's performance in officer training and in combat, but we did so by evaluating his behavior over one hour in an artificial situation. This was a perfect instance of a general rule that I call WYSIATI, "What you see is all there is." We had made up a story from the little we knew but had no way to allow for what we did not know about the individual's future, which was almost everything that would actually matter. When you know as little as we did, you should not make extreme predictions like "He will be a star."

Mood evidently affects the operation of System 1: when we are uncomfortable and unhappy, we lose touch with our intuition. These findings add to the growing evidence that good mood, intuition, creativity, gullibility, and increased reliance on System 1 form a cluster. At the other pole, sadness, vigilance, suspicion, an analytic approach, and increased effort also go together. A happy mood loosens the control of System 2 over performance: when in a good mood, people become more intuitive and more creative but also less vigilant and more prone to logical errors.

People are very good [at] thinking about agents. The mind is set really beautifully to think about agents. Agents have traits. Agents have behaviors. We understand agents. We form global impression of their personalities. We are really not very good at remembering sentences where the subject of the sentence is an abstract notion.

Unfortunately, skill in evaluating the business prospects of a firm is not sufficient for successful stock trading, where the key question is whether the information about the firm is already incorporated in the price of the stock. Traders apparently lackthe skill to answer this crucial question, but they appear to be ignorant of their ignorance.