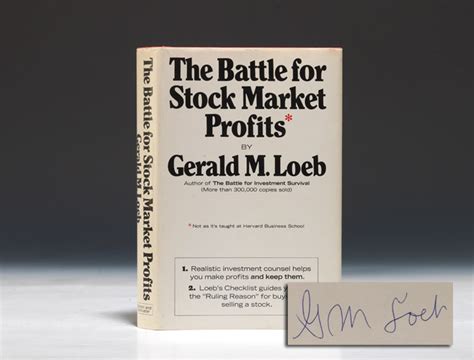

Top 10 Quotes & Sayings by Gerald M. Loeb

Explore popular quotes and sayings by an author Gerald M. Loeb.

Last updated on April 21, 2025.

I once read about a meeting of economists who agreed that if their forecasts were 33 1/3 % correct, that was considered a high mark in their profession. Well, of course, I know you cannot invest in securities successfully with odds like that against you if you place dependence solely upon judgement as to the right securities to own and the right time or price to buy them. Then, too, I read somewhere about the man who described an economist as resembling ‘a professor of anatomy who was still a virgin.’