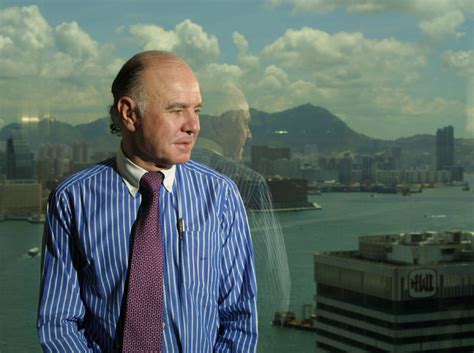

Top 60 Quotes & Sayings by Marc Faber

Explore popular quotes and sayings by an American businessman Marc Faber.

Last updated on April 14, 2025.

The entire political elite has mismanaged the Indian economy for the last 50 years. You cannot solve a crisis that is borne as a symptom of mismanagement in just five minutes or in a week. It will involve significant sacrifices and pain, and I doubt that in India there is the political will to face the music.

In the 40 years I've been working as an economist and investor, I have never seen such a disconnect between the asset market and the economic reality... Asset markets are in the sky, and the economy of the ordinary people is in the dumps, where their real incomes adjusted for inflation are going down and asset markets are going up.

I am pretty sure central banks will continue to print money, and the standards of living for people in the western world, not just in America, will continue to decline because the cost of living increases will exceed income. The cost of living will also go up because all kinds of taxes will increase.

If the U.S. Government was a company, the deficit would be $5 trillion because they would have to account by general accepted accounting principles. But actually they encourage government spending, reckless government spending, because the government can issue Treasury bills at extremely low interest rates.

Our best long-term and intermediate cycles suggest another slowdown and stock crash accelerating between very early 2014 and early 2015, and possibly lasting well into 2015 or even 2016. The worst economic trends due to demographics will hit between 2014 and 2019. The U.S. economy is likely to suffer a minor or major crash by early 2015 and another between late 2017 and late 2019 or early 2020 at the latest.