Top 18 Quotes & Sayings by Robert Mundell

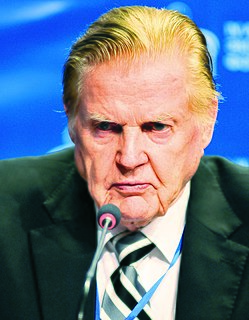

Explore popular quotes and sayings by a Canadian economist Robert Mundell.

Last updated on September 17, 2024.

The problem started before World War I. The gold standard was working fairly well. But it broke down because of the war and what happened in the 1920s. And then the U.S. started to become so dominant in the world, with the dollar becoming the central currency after the 1930s, the whole world economy shifted.