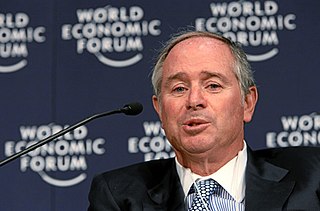

Top 97 Quotes & Sayings by Stephen A. Schwarzman

Explore popular quotes and sayings by an American businessman Stephen A. Schwarzman.

Last updated on December 22, 2024.

I have a saying: There are no brave old people in finance. Because if you're brave, you mostly get destroyed in your 30s and 40s. If you make it to your 50s and 60s and you're still prospering, you have a very good sense of how to avoid problems and when to be conservative or aggressive with your investments.

Every year, I speak to our new associates and give them this advice, although in my own words. 'This isn't like school,' I tell them, 'where you want to get your hand in the air and give an answer quickly. The only grade here is 100. Deadlines are important, but at Blackstone you can always get help in meeting them.'

Part of China's strategic planning is to make their universities among the top level of the world, and I think they understand you can't do that without the adoption of some of the principles of the great universities in the West; one of those is the ability to have free expression and discussion in the classroom.