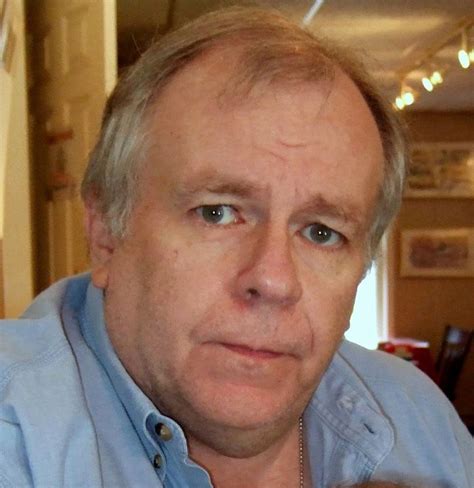

Top 27 Quotes & Sayings by T.R. Reid

Explore popular quotes and sayings by an American reporter T.R. Reid.

Last updated on April 14, 2025.

There's a tradeoff. Yeah, I lose the deduction that I really like, but my tax rate is going to go down, and I don't have to fill out that form anymore. It's much simpler, rates are lower, and that tradeoff has worked in many countries. Many countries have just cleaned house of all those exemptions in order to provide lower rates, and people buy it.

Americans spend about 6 billion hours a year collecting the data and filling out the forms. We spend $10 billion to H&R Block and other preparers. And on top of that, $2 billion in tax preparation software, which still takes hours of work. It's outrageous the burden we put on people, and guess what, you go to Europe, you go to Japan, it's 15 minutes and costs nothing.

Mortgage is one of the most popular deductions. It costs the Treasury about $103 billion a year. Now that's money we could use to treat wounded veterans or reduce the deficit or fill the border. Instead, we give it a subsidy to homeowners, and it goes mainly to the richest homeowners in America, because only one third of Americans itemize their deductions. It doesn't work. Many countries have gotten rid of the mortgage interest deduction. Almost all of them have higher homeownership rates than we do.

President Trump repeatedly says that "America is the highest-taxed country in the world." This is an alternative fact. We pay less in taxes, and our government spends less, as a share of our total wealth, than our counterparts in Western Europe and East Asia. But Trump is right when it comes to corporate tax rates; the U.S. corporate income tax right is among the highest in the world.

It turns out a VAT - a value-added tax - is a very easy tax to collect and a very hard tax to evade. It's a really good idea. It was invented about 60 years ago in France, of course. Because they're so good at taxing. They had a business tax that was easy to evade, and the head of the French IRS invented this value-added tax, which is very hard to evade.

Starting in the '80s or so, after the United States sharply cut its rates, other countries decided they better do it too, and here's how you do it: you just wipe out the exemptions, the deductions, the credits, the depreciation allowances. And people complain, "Oh my God, it's terrible," but you give them much lower rates and you give them an easier form to file, and people accept that tradeoff.

The Value-Added Tax, a sales tax that applies at every level of business transactions, is an easy tax for governments to collect, and a hard tax to evade. So it makes the job of raising revenue easier. The revenues from the VAT can then be used to lower taxes on income and saving and investment. The Value-Added tax doesn't penalize work or saving; it's a tax on buying stuff.

You also get a deduction in America for taking a night school course, growing sugarcane, moving to a new city for a job, replanting a forest, insulating the attic, destroying old farm equipment, employing Native Americans, commuting to work by bicycle - but only if the bike is regularly used for a substantial portion of travel - or buying a plug-in hybrid sports car, or buying a recreational vehicle. I mean there are hundreds of them, and most of them are nuts.

If you ask any economist, they'll tell you all the mortgage interest deduction does is raise the price of the house. So a couple is out looking at the house, they say, "Oh, we love this house, but we couldn't make the monthly payment." And the realtor says, "Yeah, but you're going to get a tax break." So people pay more than they would otherwise. You take a loss even though you're making a gain.

It was an easy thing to tax for a young country. And then gradually we moved to property taxes, manufacturing taxes, and the income tax was the answer to a populist demand: Let's go after the rich guys. We got into World War I, and they raised the rates and started taxing the rich. Then we got into World War II, and that's when they taxed everybody, because they just needed more revenue.