Top 53 Quotes & Sayings by William Mougayar

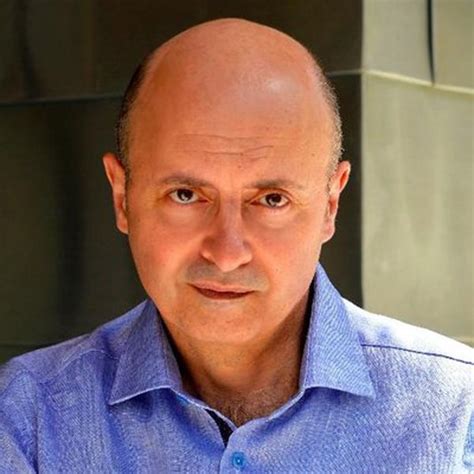

Explore popular quotes and sayings by a Canadian businessman William Mougayar.

Last updated on April 21, 2025.

The blockchain is custom-made for decentralizing trust and exchanging assets without central intermediaries. With the decentralization of trust, we will be able to exchange anything we own and challenge existing trusted authorities and custodians that typically held the keys to accessing our assets or verifying their authenticity.

Cryptocurrencies are not evil and are not for money launderers and scammers. They are for entrepreneurs, technologists, change-the-world dreamers, and anyone who believes they can (and will) enable new business models, new types of organizations, and new ways to service consumers and businesses alike.

A blockchain-based startup could have a product/service as part of what they are developing, but their stride is best hit when they are also creating a self-sustaining circular economy that is supported by their own currency or tokens and where there is a transactional loop between earning and spending these tokens within their ecosystem.