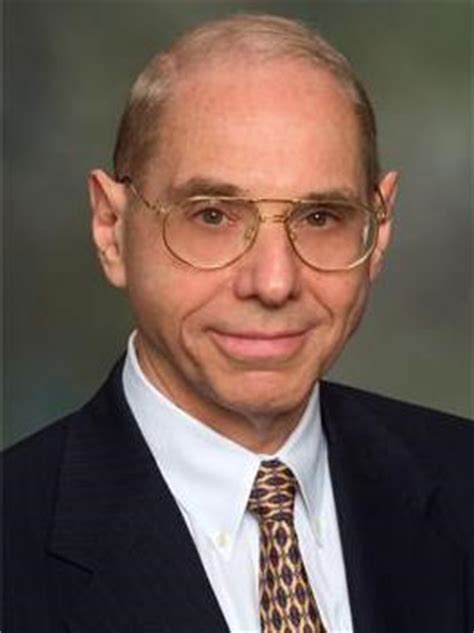

Top 12 Quotes & Sayings by William O'Neil

Explore popular quotes and sayings by an American entrepreneur William O'Neil.

Last updated on April 14, 2025.

The market has a simple way of whittling all excessive pride and overblown egos down to size. After all, the whole idea is to be completely objective and recognize what the marketplace is telling you, rather than try to prove that the thing you said or did yesterday or six weeks ago was right. The fastest way to take a bath in the stock market or go broke is to try to prove that you are right and the market is wrong.