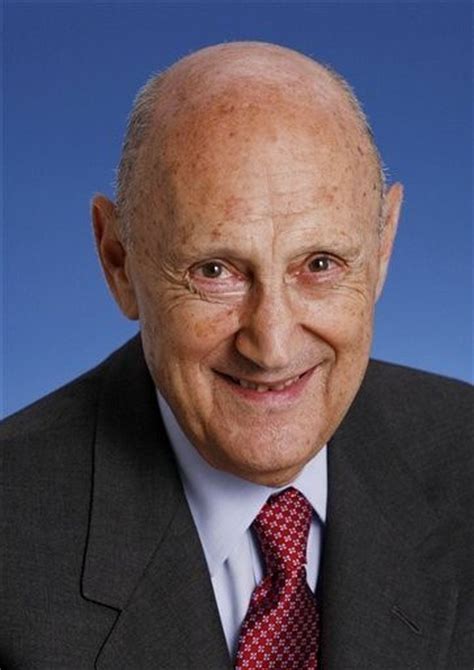

Top 16 Quotes & Sayings by Burton Malkiel

Explore popular quotes and sayings by an American economist Burton Malkiel.

Last updated on December 25, 2024.

Experience conclusively shows that index-fund buyers are likely to obtain results exceeding those of the typical fund manager, whose large advisory fees and substantial portfolio turnover tend to reduce investment yields. Many people will find the guarantee of playing the stock-market game at par every round a very attractive one. The index fund is a sensible, serviceable method for obtaining the market's rate of return with absolutely no effort and minimal expense.

Index funds are... tax friendly, allowing investors to defer the realization of capital gains or avoid them completely if the shares are later bequeathed. To the extent that the long-run uptrend in stock prices continues, switching from security to security involves realizing capital gains that are subject to tax. Taxes are a crucially important financial consideration because the earlier realization of capital gains will substantially reduce net returns.

J.P. Morgan once had a friend who was so worried about his stock holdings that he could not sleep at night. The friend asked, 'What should I do about my stocks?' Morgan replied, 'Sell down to your sleeping point' Every investor must decide the trade-off he or she is willing to make between eating well and sleeping well. High investment rewards can only be achieved at the cost of substantial risk-taking. So what is your sleeping point? Finding the answer to this question is one of the most important investment steps you must take.

Index funds have regularly produced rates of return exceeding those of active managers by close to 2 percentage points. Active management as a whole cannot achieve gross returns exceeding the market as a while and therefore they must, on average, underperform the indexes by the amount of these expense and transaction costs disadvantages.