Top 1200 Mortgage Rate Quotes & Sayings

Explore popular Mortgage Rate quotes.

Last updated on November 14, 2024.

Poverty is not a mortgage on the labor of others-misfortu ne is not a mortgage on achievement-fai lure is not a mortgage on success-sufferi ng is not a claim check, and its relief is not the goal of existence-man is not a sacrificial animal on anyone’s altar nor for anyone’s cause-life is not one huge hospital.

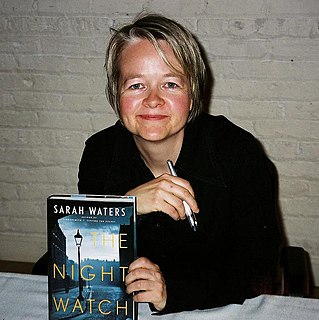

I live in a Spanish-style hillside home in Los Angeles, California. I paid $900,000 in 1995. It's perhaps worth about $3m now. Thankfully, I paid off my mortgage before the crash because I could see it coming. I worried that I would be caught having to pay off a very high mortgage for a house I couldn't sell.

What if one were up there, drifting about among suns and feeling the tails of comets fan one's forehead! How small the earth was and how puny the people; a Norway of two million provincial souls and a mortgage bank to help feed them! What was life worth at such a rate? You elbowed yourself ahead in the sweat of your face for a few mortal years, only to perish all the same, all the same!

What central banks can control is a base and one way they can control the base is via manipulating a particular interest rate, such as a Federal Funds rate, the overnight rate at which banks lend to one another. But they use that control to control what happens to the quantity of money. There is no disagreement.

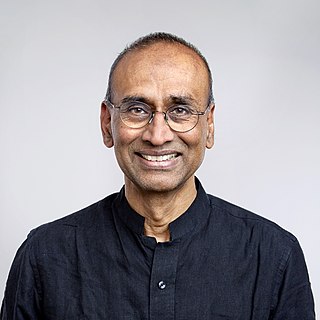

The rate of growth of the relevant population is much greater than the rate of growth in funds, though funds have gone up very nicely. But we have been producing students at a rapid rate; they're competing for funds and therefore they're more frustrated. I think there's a certain sense of weariness in the intellectual realm, it's not in any way peculiar to economics, it's a general proposition.

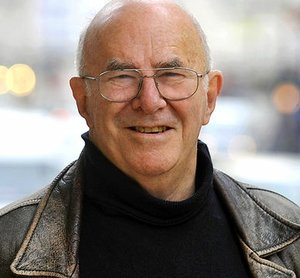

My motivation is paying the mortgage. No joke. Honestly. I still suffer with nerves and think, 'Why am I putting myself through this torture?' It's not actually the love of winning - it's that building of a partnership with a horse. Just riding horses every day keeps me going. And that threat of losing the mortgage.

Both HUD and the Department of Justice began bringing lawsuits against mortgage bankers when a higher percentage of minority applicants than white applicants were turned down for mortgage loans. A substantial majority of both black and white mortgage loan applicants had their loans approved but a statistical difference was enough to get a bank sued.

No one pushed harder than Congressman Barney Frank to force banks and other financial institutions to reduce their mortgage lending standards, in order to meet government-set goals for more home ownership. Those lower mortgage lending standards are at the heart of the increased riskiness of the mortgage market and of the collapse of Wall Street securities based on those risky mortgages.

he economy favors throughput over quality and craftsmanship, and economists are terrified because the American savings rate has crept upward from about zero to almost five percent. But the mortgage crisis and the burgeoning credit card crisis are causing Americans to become wary of irresponsible debt.

Many politicians and pundits claim that the credit crunch and high mortgage foreclosure rate is an example of market failure and want government to step in to bail out creditors and borrowers at the expense of taxpayers who prudently managed their affairs. These financial problems are not market failures but government failure. ... The credit crunch and foreclosure problems are failures of government policy.

If a country is an attractive place for foreigners to invest their funds, then that country will have a relatively high exchange rate. If it's an unattractive place, it will have a relatively low exchange rate. Those are the fundamentals that determine the exchange rate in a floating exchange rate system.

Mint's business model became, 'We'll go for free, and then we'll find these savings opportunities for you.' You know, better interest rate on your credit cards, when should you consolidate your student loans, when does it mathematically make sense to refinance your mortgage, and Mint figures all that stuff out for you.

As you know, you go to war with the army you have, not the army you might want or wish to have at a later time. Since the Iraq conflict began, the Army has been pressing ahead to produce the armor necessary at a rate that they believe - it's a greatly expanded rate from what existed previously, but a rate that they believe is the rate that is all that can be accomplished at this moment.