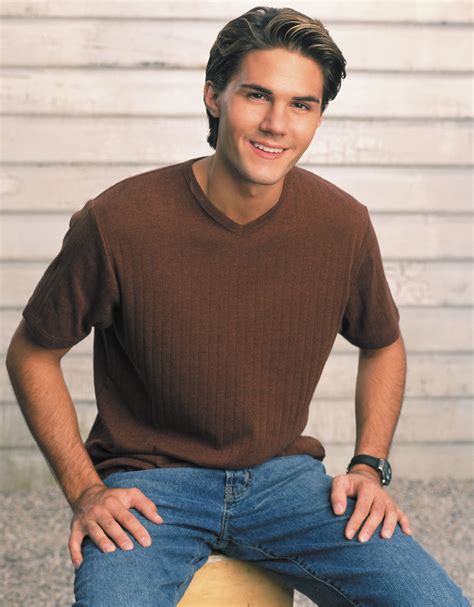

A Quote by Adam LaVorgna

The financial wealth that has been created is unprecedented. Even if the stock market, for argument's sake, leveled off here, there's been so much wealth built up that we really can feel spending for some time.

Related Quotes

Jobs are just about the best they've ever been. We've created almost $4 trillion in wealth if you look at your stock values and you look at what's going on with our country. But we've created tremendous wealth. The enthusiasm and spirit on every single index is higher than it's ever been before for our manufacturers and for our companies. After spending billions of dollars defending other people's borders, we are finally going to defend our borders.

If you are a gamer, it’s time to get over any regret you might feel about spending so much time playing games. You have not been wasting your time. You have been building up a wealth of virtual experience that, as the first half of this book will show you, can teach you about your true self: what your core strengths are, what really motivates you, and what make you happiest.

If you have good wealth mentality.... you will generate wealth wherever you go. Even if you lose money temporarily, your wealth mentality will attract it again. If you have a lack mentality, no matter how much you receive or what financial opportunities come your way, wealth will evade you or, if it comes, it won't last.

The reality is that business and investment spending are the true leading indicators of the economy and the stock market. If you want to know where the stock market is headed, forget about consumer spending and retail sales figures. Look to business spending, price inflation, interest rates, and productivity gains.

The underlying strategy of the Fed is to tell people, "Do you want your money to lose value in the bank, or do you want to put it in the stock market?" They're trying to push money into the stock market, into hedge funds, to temporarily bid up prices. Then, all of a sudden, the Fed can raise interest rates, let the stock market prices collapse and the people will lose even more in the stock market than they would have by the negative interest rates in the bank. So it's a pro-Wall Street financial engineering gimmick.

If exclusive privileges were not granted, and if the financial system would not tend to concentrate wealth, there would be few great fortunes and no quick wealth. When the means of growing rich is divided between a greater number of citizens, wealth will also be more evenly distributed; extreme poverty and extreme wealth would be also rare.