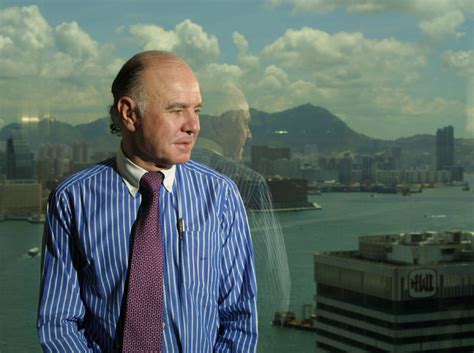

A Quote by Alan Greenspan

Gold still represents the ultimate form of payment in the world. Fiat money in extremis is accepted by nobody. Gold is always accepted.

Related Quotes

My treasure chest is filled with gold.

Gold . . . gold . . . gold . . .

Vagabond's gold and drifter's gold . . .

Worthless, priceless, dreamer's gold . . .

Gold of the sunset . . . gold of the dawn . . .Gold of the showertrees on my lawn . . .

Poet's gold and artist's gold . . .

Gold that can not be bought or sold -

Gold.

The obsession with gold, actually and politically, occurs among those who regard economics as a branch of morality. Gold is solid, gold is durable, gold is rare, gold is even (in certain very peculiar circumstances) convertible. To believe in thrift, solidity and soundness is to believe in some way in the properties of gold.

A currency serves three functions: providing a means of payment, a unit of account and a store of value. Gold may be a store of value for wealth, but it is not a means of payment. You cannot pay for your groceries with it. Nor is it a unit of account. Prices of goods and services, and of financial assets, are not denominated in gold terms.

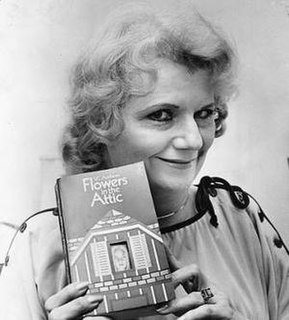

Gold is unique because it has the age-old aspect of being viewed as a store of value. Nevertheless, it’s still a commodity and has no tangible value, and so I would say that gold is a speculation. But because of my fear about the potential debasing of paper money and about paper money not being a store of value, I want some exposure to gold.

The major asset in this category is gold, currently a huge favorite of investors who fear almost all other assets, especially paper money (of whose value, as noted, they are right to be fearful). Gold, however, has two significant shortcomings, being neither of much use nor procreative. True, gold has some industrial and decorative utility, but the demand for these purposes is both limited and incapable of soaking up new production. Meanwhile, if you own one ounce of gold for an eternity, you will still own one ounce at its end.