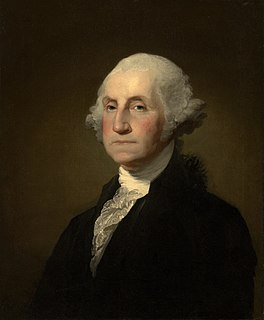

A Quote by Barack Obama

I want to reform the tax code so that it's simple, fair, and asks the wealthiest households to pay higher taxes on incomes over $250,000 - the same rate we had when Bill Clinton was president; the same rate we had when our economy created nearly 23 million new jobs, the biggest surplus in history, and a lot of millionaires to boot.

Related Quotes

So I'm not proposing anything radical. I just believe that anybody making over $250,000 a year should go back to the income tax rates we were paying under Bill Clinton. Back when our economy created nearly 23 million new jobs, the biggest budget surplus in history, and plenty of millionaires to boot. ... At the same time, most people agree that we should not raise taxes on middle-class families or small businesses -- not when so many folks are just trying to get by.

When you say the tax system benefits the rich, there are a lot of people who respond, "That can't be true, look at the rate of tax. The people who are rich pay a higher rate than you or I." Well, yeah, but if you don't have to pay taxes on a lot of your income, then your real tax rate is a lot lower. And if you're allowed to pay your taxes thirty years from now instead of today then you're a lot better off. People need to have a sophisticated understanding of how the system works to appreciate that the posted tax rate really has very little to do with the taxes people pay.

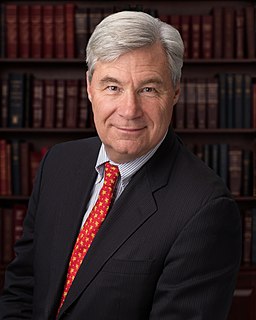

According to the IRS, the wealthiest 400 Americans, who earned an average of roughly $270 million in 2008, paid an average tax rate of just 18.2 percent that year. That's about the same rate paid by a single truck driver in Rhode Island. It's not right, and we need to restore fairness to our tax code.

First, the oil and gas business pays its fair share of taxes. Despite the current debate on energy taxes, few businesses pay more in taxes than oil and gas companies. The worldwide effective tax rate for our industry in 2010 was 40 percent. That's higher than the U.S. statutory rate of 35 percent and the rate for manufacturers of 26.5 percent.

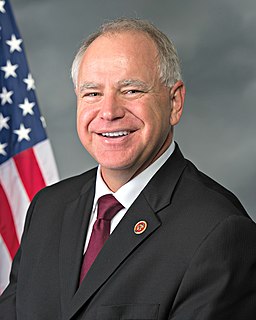

Barack Obama is talking about cutting taxes. On net, he is a tax cutter. But the difference between Obama and John McCain is that Obama is raising some taxes on families, for example, with incomes over $250,000. Now, that amounts to about 2 percent, the richest 2 percent of American households. And even with those tax changes, even with all of the tax changes Obama's talking about, taxes will be lower under Obama than they were under the Clinton years.

Now, the president would like to do tax reform, which would obviously lower rates for most people in America and make the tax code fair and get rid of loopholes and special treatment. But absent tax reform, the president believes the right way to get our fiscal house in order is ask the wealthy to pay their fair share.

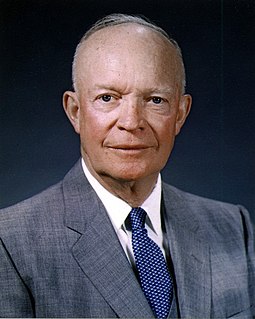

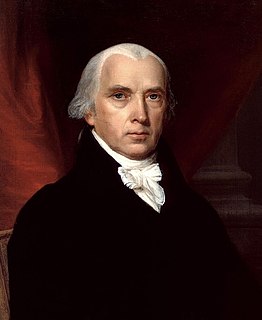

My plan has all that. It's energy independence. It will help our economy. It's a significant tax cut for corporations, including automatic expensing. It's bringing all those profits home from Europe without any taxation. It's lowering our corporate - or our personal rate to 28 percent, the same rate that Ronald Reagan had.

You got to remember, S corporations pay one layer of tax, corporations pay two layers of tax. So we basically see equivalent, but here`s the point. The rest of the world, they tax their businesses at an average rate in the industrialized world of 23 percent. Our corporate is 35. Our top S corporate, small business rate is 44.6 effectively. This is killing us.

I support both a Fair Tax and a Flat Tax plan that would dramatically streamline the tax system. A Fair Tax would replace all federal taxes on personal and corporate income with a single national tax on retail sales, while a Flat Tax would apply the same tax rate to all income with few if any deductions or exemptions.

We need to enact fundamental tax reform. The weight and complexity of our 73,000-page tax code are crushing everyday Americans. We need to radically simplify the tax code so that we can re-start the real engine of growth in our economy. That means our tax code needs to go from 73,000 pages down to about three pages.

The reason we've been growing at 1.8 percent for the last eight, ten years, which is way below the historical average, is in large part because of our tax code. It is important to us to get the biggest, broadest tax reduction, tax cuts, tax reform that we can possibly get because it's the only way we get back to 3 percent growth. That's what's driving all of this, how do you get the American economy back on that historical growth rate of 3 percent and out of these doldrums of 1.8, 1.9 that we had of the previous Barack Obama administration?