A Quote by Benjamin Disraeli

To tax the community for the advantage of a class is not protection: it is plunder.

Related Quotes

Why, I say, that to tax the community for the advantage of a class is not protection; it is plunder, and I entirely disclaim it; but I ask you to protect the rights and interests of labour generally in the first place, by allowing no free imports from countries which meet you with countervailing duties; and, in the second place, with respect to agricultural produce, to compensate the soil for the burdens from which other classes are free by an equivalent duty. This is my view of what is called "protection."

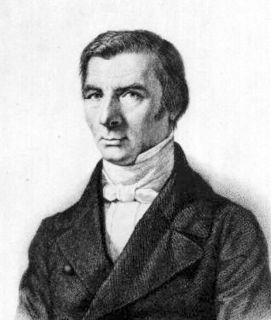

Legal plunder can be committed in an infinite number of ways; hence, there are an infinite number of plans for organizing it: tariffs, protection, bonuses, subsidies, incentives, the progressive income tax, free education, the right to employment, the right to profit, the right to wages, the right to relief, the right to the tools of production, interest free credit, etc., etc. And it the aggregate of all these plans, in respect to what they have in common, legal plunder, that goes under the name of socialism.

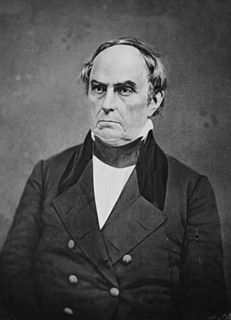

In the nature of things, those who have no property and see their neighbors possess much more than they think them to need, cannot be favorable to laws made for the protection of property. When this class becomes numerous, it becomes clamorous. It looks on property as its prey and plunder, and is naturally ready, at times, for violence and revolution.

If one individual, or one class, can call in the aid of authority to ward off the effects of competition, it acquires a privilege and at the cost of the whole community; it can make sure of profits not altogether due to the productive services rendered, but composed in part of an actual tax upon consumers for its private profit' which tax it commonly shares with the authority that thus unjustly lent its support.

Assuming that a tax increase is necessary, it is clearly preferable to impose the additional cost on land by increasing the land tax, rather than to increase the wage tax - the two alternatives open to the City (of Pittsburgh). It is the use and occupancy of property that creates the need for the municipal services that appear as the largest item in the budget - fire and police protection, waste removal, and public works. The average increase in tax bills of city residents will be about twice as great with wage tax increase than with a land tax increase.

High tax rates in the upper income brackets allow politicians to win votes with class warfare rhetoric, painting their opponents as defenders of the rich. Meanwhile, the same politicians can win donations from the rich by creating tax loopholes that can keep the rich from actually paying those higher tax rates - or perhaps any taxes at all. What is worse than class warfare is phony class warfare. Slippery talk about 'fairness' is at the heart of this fraud by politicians seeking to squander more of the nation's resources.

As for loving woman, I have never understood why some people had a fit. I still don't. It seems fine to me. If an individual is productive responsible, and energetic, why should her choice in a partner make such a fuss? The government is only too happy to take my tax money and yet they uphold legislation that keeps me a second class citizen. Surely, there should be a tax break for those of us who are robbed of full and equal participation and protection in the life of our nation.

We certainly could have voted on making the middle-class tax cuts and tax cuts for working families permanent had the Republicans not insisted that the only way they would support those tax breaks is if we also added $700 billion to the deficit to give tax breaks to the wealthiest 2 percent of Americans. That's what was really disturbing.

Let me have my tax money go for my protection and not for my prosecution. Let my tax money go for the protection of me. Protect my home, protect my streets, protect my car, protect my life, protect my property...worry about becoming a human being and not about how you can prevent others from enjoying their lives because of your own inability to adjust to life.