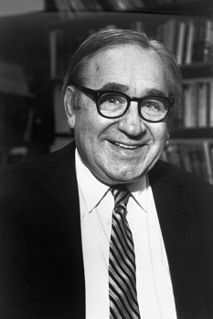

A Quote by Bernie Sanders

The Federal Reserve has the responsibility to protect the credit rights of consumers.

Related Quotes

Judges are the people who have to protect the rights of individuals, have to protect the rights of minorities, have to protect the rights in the Constitution, have to protect the requirement that the executive and the legislature not simply exercise raw power but adhere to standards of reasonableness and constitutionality.

Transparency concerning the Federal Reserve's conduct of monetary policy is desirable because better public understanding enhances the effectiveness of policy. More important, however, is that transparent communications reflect the Federal Reserve's commitment to accountability within our democratic system of government.