A Quote by Brad Feld

While I'm a venture capitalist who invests in early-stage tech companies, I often feel like a professional emailer and conference call maker. I try to spend most of my time doing whatever the companies we are investors in need me to do.

Related Quotes

When the trust is high, you get the trust dividend. Investors invest in brands people trust. Consumers buy more from companies they trust, they spend more with companies they trust, they recommend companies they trust, and they give companies they trust the benefit of the doubt when things go wrong.

I think that we can all learn from what smart companies are doing. My objective is to demonstrate what's possible, even during tough economic times. This is a period of great business dislocation, but that means it's also the time to try new things. This will be a challenge for existing companies. But the behaviors of smart companies can be learned.

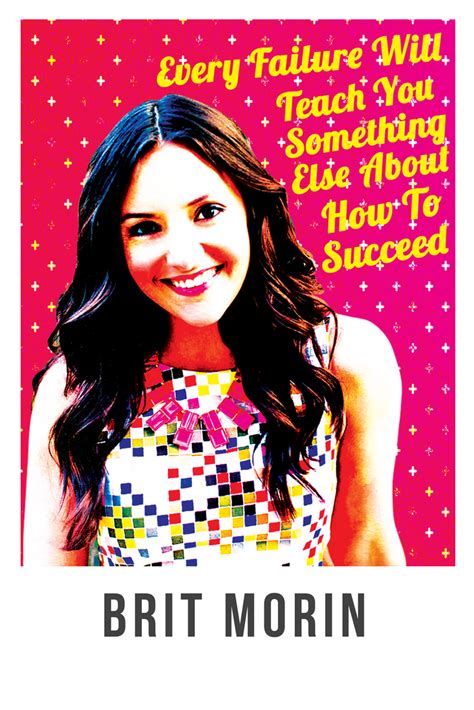

While it's true that women are the minority in most tech companies, I don't think that inhibits entry into the tech space. My motto has always been, 'Live What You Love,' and as such, I think it's incredibly important to do work you believe in and to work for a company that has values that align with your own, be it in tech or another industry.