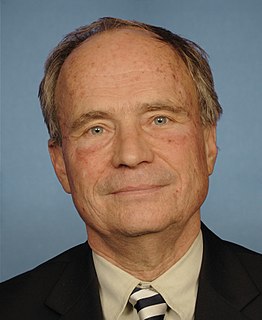

A Quote by Charles Bass

There is a difference between strategic or technical default and default where you really don't have the economy to support the spending. We are not at that point yet. We could be. We could be, like some European nations.

Related Quotes

I think the credit default swaps can take the place of the rating agencies who really have missed the ball in this procedure and are quite conflicted by the way the ratings are paid for. So, I would like to see credit default swaps become an evermore important way of understanding credit risk in the economy.

Time is running out fast. I think we have maybe a few months -- it could be weeks, it could be days -- before there is a material risk of a fundamentally unnecessary default by a country like Spain or Italy which would be a financial catastrophe dragging the European banking system and North America with it. So they have to act now.

The best companies with the strongest credit ratings borrow like the United States: on a non-prioritized basis. This means that in the event of a default, all of their debts are of equal priority because lenders and creditors believe default is highly unlikely. And they spend considerable effort maintaining this status.