A Quote by Christine Lagarde

If inflation is the genie, then deflation is the ogre that must be fought decisively.

Related Quotes

With QE3, we are essentially being bought out with our own money...and unemployment is being used to facilitate this process in a very clever manner. Monetary inflation is currently being offset by labor deflation. The way you avoid collapse is by printing money and stealing assets. The way you avoid inflation is with labor deflation.

Significant changes in the growth rate of money supply, even small ones, impact the financial markets first. Then, they impact changes in the real economy, usually in six to nine months, but in a range of three to 18 months. Usually in about two years in the US, they correlate with changes in the rate of inflation or deflation."

"The leads are long and variable, though the more inflation a society has experienced, history shows, the shorter the time lead will be between a change in money supply growth and the subsequent change in inflation.

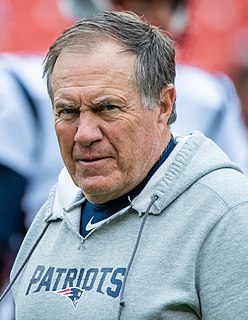

I've learned about the inflation range situation. Obviously with our footballs being inflated to the 12.5-pound range, any deflation would then take us under that specification limit. Knowing that now, in the future we will certainly inflate the footballs above that low level to account for any possible change during the game.