A Quote by Christopher Martenson

Here's what peak oil is - it's not running out. It's that you no longer can produce more, and more, and more, year after year. World oil production has been going up about 1.8-2 percent per annum for decades. And that's what the world economy got attuned to.

Related Quotes

If you say the world is totally dependent on oil in many parts of the world, coal and certainly natural gas, we are fossil fuel, that is modernity, modernity has two elements: individualism and oil. Now to move toward a more enlightened sustainable world, we have to transform with lots of technology, with even differences in the way we see the world and how we live in the world. That`s going to take decades.

There's a huge misconception that it's all about the oil, and the truth is there's actually not much oil left in Abyei. The misperception arose because when the peace agreement was signed in 2005, Abyei accounted for a quarter of Sudan's oil production. Since then, the Permanent Court of Arbitration in The Hague defined major oil fields to lie outside Abyei. They're in the north now, not even up for grabs, and they account for one percent of the oil in Sudan. The idea that it's "oil-rich Abyei" is out of date.

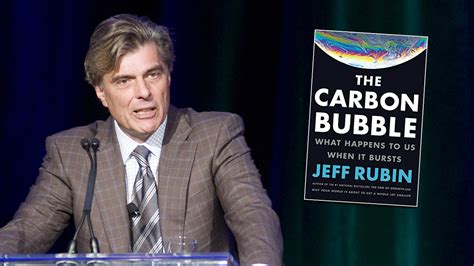

All of the easy oil is gone and what's left is requiring more energy and money and this has an effect on everything. Our problem is that we've created an infrastructure that's so dependent on oil. As oil becomes more expensive we're going to be locked into the transportation modes that our economy depends on. So we really need to start building an alternative economy before we get caught in a trap of our own making.

Saudi Arabian oil production is at or very near its peak sustainable volume (if it did not, in fact peak almost 25 years ago), and is likely to go into decline in the very foreseeable future. There is only a small probability that Saudi Arabia will ever deliver the quantities of petroleum that are assigned to it in all the major forecasts of world oil production and consumption.

If you really think that houses prices are going to go up next year and the year after, you feel if I don't buy it this year, I'm going to have to buy it next year. [...] And when somebody makes it very easy for you to do it by saying you don't really have to put up my money, you can lie about your income a little, or we'll give you 100 percent mortgage, you're going to do it, because everybody that's done it has been proven right. You have what they call social tools, and, you know, you're going to feel like an idiot if you didn't do it, because the house cost more.

If you're going to buy something which compounds for 30 years at 15% per annum and you pay one 35% tax at the very end, the way that works out is that after taxes, you keep 13.3% per annum. In contrast, if you bought the same investment, but had to pay taxes every year of 35% out of the 15% that you earned, then your return would be 15% minus 35% of 15%-or only 9.75% per year compounded. So the difference there is over 3.5%. And what 3.5% does to the numbers over long holding periods like 30 years is truly eye-opening.

Probably no single event highlights the strength of Campbell's argument (on peak oil) better than the rapid development of the Alberta tar sands. Bitumen, the world's ugliest and most expensive hydrocarbon, can never be a reasonable substitute for light oil due to its extreme capital, energy, and carbon intensity. Bitumen looks, smells, and behaves like asphalt; running an economy on it is akin to digging up our existing road infrastructure, melting it down, and enriching the goop with hydrogen until it becomes a sulfur-rich but marketable oil.

Here in the United States we're now consuming about three gallons of petroleum per person per day. That's twenty pounds of oil per person per day. We only consume about four pounds of oxygen per person per day. We're consuming five times more oil each day, here in the United States than we are oxygen. We've become the oil tribe.

I basically don't think that the way we do things is that dependent on one resource, such as oil. There can be different kinds of engines for cars. I think that solar heating, wind heating can substitute for a lot of uses for oil. I'd like to see those things happen because they are more sustainable in any case. But I do not think that running out of oil is not going to bother us that much. I think we have got to be rescued by something or we really are going down a slippery slope.