A Quote by Cleta Mitchell

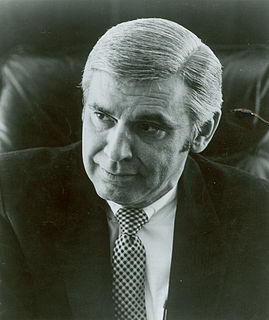

The day after Republicans won solid majorities in the House and Senate, House Speaker John Boehner and Senate Majority Leader-to-be Mitch McConnell outlined priorities for the newly elected Congress. High on the list is fundamental tax reform. In addition to overhauling the federal tax code, however, Congress should rein in the Internal Revenue Service.

Related Quotes

It's time for me to give out an award to newly elected Majority Leader John Boehner. Mr. Boehner was elected just a few days ago to reform House Republicans, who are feeling the heat from lobbyist scandals. Well, CNN found out that he rents his two-bedroom apartment from a lobbyist who had clients who had interests in legislation that Boehner sponsored. And for that, Mr. Boehner, you've just won a pair of Stephen Colbert's big brass balls.

John Marshall's warning that the power to tax is the power to destroy has taken on far greater meaning... more specifically, the power of the Internal Revenue Service is threatening to destroy the freedom of religion , guaranteed by the First Amendment. As part of that guarantee, Congress has granted tax exemptions for churches to avoid excessive interference in their religious activities.

I took office as president in January 2003, and in April 2003, I sent to Congress my first proposal for tax reform. Some parts were voted on, with respect to federal taxes, and then it came to a standstill. Why? Because each state is interested in its own tax reform, has its own tax policy, and each state has its federal deputies and senators.

With all of the talk about polling and demographics, I think too many people have lost touch with the human and moral crisis of deportations. Every day, roughly 1,000 people are deported because the Republican leadership of the House of Representatives is denying the majority of the US Congress a chance to vote on citizenship. I will be arrested today because the labor movement stands with the families tragically ripped apart by John Boehner and the House Republicans’ embrace of a broken immigration system.

Be it enacted by the Senate and House of Representatives of the United States of America in Congress assembled, That (a) the President of the United States is authorized to present, on behalf of the Congress, a gold medal of appropriate design to the family of the late Honorable Leo J. Ryan in recognition of his distinguished service as a Member of Congress and the fact of his untimely death by assassination while performing his responsibilities as a Member of the United States House of Representatives.

The real estate lobby has prominent allies in both parties. After the last major overhaul of the tax code, in 1986 - under a Republican president, Ronald Reagan, a Republican Senate and a Democratic House - it was a Democrat, Bill Clinton, who signed legislation that restored lost real estate tax breaks seven years later.