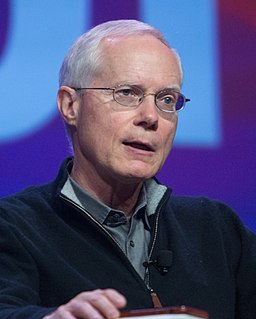

A Quote by Dan Schulman

We're trying to democratise financial services, to ensure that management and movement of money is a right for all citizens, not the privilege of the affluent.

Related Quotes

Most governments want their citizens to be part of the financial system, to be productive citizens as a result of having access to be able to manage and move money in a seamless way. But the traditional financial services infrastructure is not designed to handle that because, predominantly, it's an expensive infrastructure.

By any measure, CapitalSource outperformed both our direct competitors and the financial services industry in general, particularly in the context of the near collapse of the financial services industry where 19 of the 20 largest financial institutions in the country either failed or were bailed out by the government.

Good money management alone isn't going to increase your edge at all. If your system isn't any good, you're still going to lose money, no matter how effective your money management rules are. But if you have an approach that makes money, then money management can make the difference between success and failure.

I have been an organizer and then activist and a legislator, all of that. But then there's this big gap after I advanced in Congress and ended up as the ranking member of financial services committee. It took me into the financial services issues and Wall Street and Dodd Frank. And it took me away from the things that I did years ago.