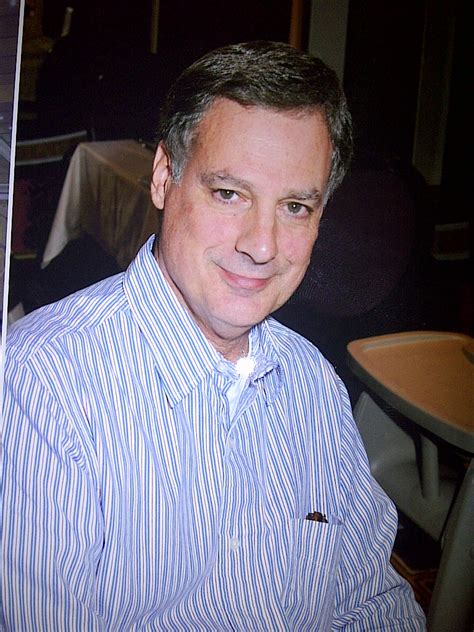

A Quote by David Lereah

The drop in pending home sales is an affirmation that we are experiencing a modest slowing in the housing sector.

Quote Topics

Related Quotes

I think what happens in a religious life is that we have those experiences of affirmation and that one starts to live a Christian life or a Jewish life or a Muslim life or a Buddhist life, by affirming that affirmation each day. Each day you say 'Yes' to that Yes. So the life of being a Christian for example, is always a life of double affirmation, that you each day say 'Yes' to those counter-experiences of saying 'Yes', even when you're not experiencing them at that time, you're remaining loyal to that experience.

I had an approach where everything that's happening it should be as though it's an experience for somebody. So if you're experiencing a hurricane, if you're experiencing a car crash or whatever it is, you're only experiencing as yourself, you're not experiencing it from some objective point of view.

We are all used to paying a sales tax when we buy things - almost 9 percent here in New York City. The application of this concept to the financial sector could solve our need for revenue, bring some sanity back into the financial sector, and give us a way to raise the revenue we need to run the government in a fiscally responsible way.