A Quote by David Suzuki

What we are doing is, rather than living on the interest of our basic biological capital, we're using up our capital, so we're dipping into our capital. We're using up what should be our children's and grandchildren's legacy.

Related Quotes

The financial doctrines so zealously followed by American companies might help optimize capital when it is scarce. But capital is abundant. If we are to see our economy really grow, we need to encourage migratory capital to become productive capital - capital invested for the long-term in empowering innovations.

Thus, the capital owner is not a parasite or a rentier but a worker - a capital worker. A distinction between labor work and capital work suggests the lines along which we could develop economic institutions capable of dealing with increasingly capital-intensive production, as our present institutions cannot.

If surface water can be compared with interest income, and non-renewable groundwater with capital, then much of the West was living mainly on interest income. California was milking interest and capital in about equal proportion. The plains states, however, were devouring capital as a gang of spendthrift heirs might squander a great capitalist's fortune.

If, for example, each of us had the same share of capital in the national total capital, then if the share of capital goes up it's not a problem, because you get as much as I do. The problem is that capital in capitalist countries is very heavily concentrated, especially financial capital. So then if the share of income from that source goes up, that actually exacerbates inequality.

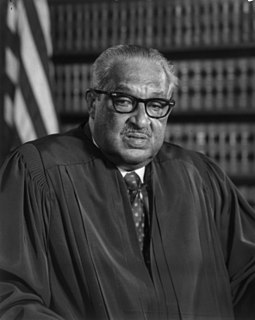

When in Gregg v. Georgia the Supreme Court gave its seal of approval to capital punishment, this endorsement was premised on the promise that capital punishment would be administered with fairness and justice. Instead, the promise has become a cruel and empty mockery. If not remedied, the scandalous state of our present system of capital punishment will cast a pall of shame over our society for years to come. We cannot let it continue.

The purpose of finance is to enable business to acquire the ownership of capital instruments before it has saved the funds to buy and pay for them. The logic used by business in investing is things that will pay for themselves is not today available to the 95% born without capital. Most of us owe instead of own. And the less the economy needs our labor, the less able we are to "save" our way to capital ownership.

Our wisdom is all mixed up with what we call our neurosis. Our brilliance, our juiciness, our spiciness, is all mixed up with our craziness and our confusion, and therefore it doesn’t do any good to try to get rid of our so-called negative aspects, because in that process we also get rid of our basic wonderfulness. We can lead our life so as to become more awake to who we are and what we’re doing rather than trying to improve or change or get rid of who we are or what we’re doing. The key is to wake up, to become more alert, more inquisitive and curious about ourselves.