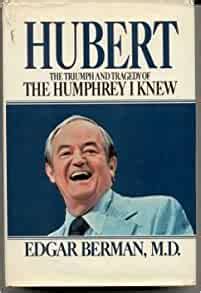

A Quote by Edgar Berman

They are wise to the ways of Wall Street - and...getting their fair share of the loot.(:)...from who will be the head of NIH, to which honorary degree will go to whom, which congressman gets the campaign funds from AMPAC (the political arm of the AMA), and whether Medicare fees can be hiked a bit for the suffering specialist. ...(or) to nominate their favorite for a Nobel Laureate.

Related Quotes

It turns out that a Nobel is also followed by other recognitions, and perhaps the most unexpected of these is that the Japan Karate Association in Tokyo has now made me an honorary 7th-degree black belt, something that, given my athletic abilities, is even more unimaginable than being an Economic Sciences Laureate.

Part of the appeal was that Medawar was not only a Nobel Laureate, but he seemed like a Nobel Laureate; he was everything one thought a Nobel Laureate ought to be. If you have ever wondered why scientists like Popper, try Medawar's exposition. Actually most Popperian scientists have probably never tried reading anything but Medawar's exposition.

If you are angry you will share anger, if you are greedy you will share greed, if you are full of lust you will share your lust. We can share only that which we have, we cannot share that which we don't have. This has to be the fundamental thing to be remembered; hence the first step is meditation and the second step is compassion.

Dean Burk, PhD, of the National Cancer Institute (head of their Cytochemistry Section and 32-year veteran at the agency) declared in a (May 30,1972) letter to (congressman Louis Frey, Jr.) that high officials of the FDA, AMA and ACS (American Cancer Society), were deliberately falsifying information, literally lying...and in other ways thwarting potential cancer cures to which they were opposed.

Within the framework of the Buddhist Path, reflecting on suffering has tremendous importance because -realizing the nature of suffering, you will develop greater resolve to put an end to the causes of suffering and the unwholesome deeds which lead to suffering. And it will increase your enthusiasm for engaging in the wholesome actions and deeds which lead to happiness and joy.

Personal size and mental sorrow have certainly no necessary proportions. A large bulky figure has a good a right to be in deep affliction, as the most graceful set of limbs in the world. But, fair or not fair, there are unbecoming conjunctions, which reason will pa tronize in vain,--which taste cannot tolerate,--which ridicule will seize.

The fund scandals shined the spotlight on the fact that mutual fund managers were putting their interests ahead of the fund shareholders who trusted them, which had much more substantial consequences in the form of excessive fees and the promotion - as the market moved into the stratosphere - of technology funds and new economy funds which were soon to collapse.