A Quote by Elizabeth Warren

We need to hold Wall Street accountable for issuing the kinds of deceptive loans that nearly brought our economy to its knees in 2008.

Related Quotes

The impact of QE on generating more lending by Wall Street to Main Street and in generating more employment and increasing overall investment in the economy is quite modest. QE probably limited the initial collapse of the economy in 2008, and likely had a very small positive impact on economic growth, but its broader impact on jobs and growth in the economy seems not very big.

Once again, the puppets on Capitol Hill are about to slam the Muppets on Main Street. The country still hasn't recovered from the Wall Street-induced financial cataclysm of 2008, yet Congress is preparing to enact the Orwellian 'JOBS Act' - a bill that should in fact be called the 'Return Fraud to Wall Street in One Easy Step Act.'

I think the money for the solutions for global poverty is on Wall Street. Wall Street allocates capital. And we need to get capital to the ideas that are successful, whether it's microfinance, whether it's through financial literacy programs, Wall Street can be the engine that makes capital get to the people who need it.

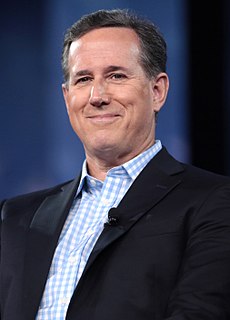

I heard governor Romney here called me an economic lightweight because I wasn't a Wall Street financier like he was. Do you really believe this country wants to elect a Wall Street financier as the president of the United States? Do you think that's the experience that we need? Someone who's going to take and look after as he did his friends on Wall Street and bail them out at the expense of Main Street America.