A Quote by Eric Idle

I don't invest in the stock market, but I have pension funds - some in America and the UK.

Related Quotes

An index fund is a fund that simply invests in all of the stocks in a market. So, for example, an index fund might invest in every single stock or almost every single stock in the U.S. market, it might invest in every single stock abroad, or it might invest in all of the bonds that are out there. And you can make a perfectly fine investing portfolio that mixes equal parts of all three of those.

The underlying strategy of the Fed is to tell people, "Do you want your money to lose value in the bank, or do you want to put it in the stock market?" They're trying to push money into the stock market, into hedge funds, to temporarily bid up prices. Then, all of a sudden, the Fed can raise interest rates, let the stock market prices collapse and the people will lose even more in the stock market than they would have by the negative interest rates in the bank. So it's a pro-Wall Street financial engineering gimmick.

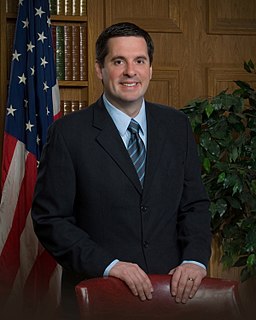

I don't invest in the stock market. I did it a long, long time ago when I was really young, and I got involved in all the investigations and all the prosecutions, and I felt it was better if I didn't make individual investments. So I'm invested in funds, but not in individual - not in individual stocks.

Are you going to divest in the banks and pension funds? Plenty of people are willing to invest in stock of those companies. You can argue that when a lot of people divest, it makes the stock price artificially low, which makes their price-to-earnings ratio more favorable, which makes it a better investment for the people who don't give a damn - - and is it really going to change corporate behavior? It begins to create a climate of antagonistic opinion, the result might be that the corporate executives will retreat even more into their own selfjustifying narratives.

We need a federal government commission to study the way our financial services system is working - I believe it is working badly - and we also need more educated investors. There are good long term low-priced mutual funds - my favorite is a total stock market index fund - and bad short term highly priced mutual funds. If investors would get themselves educated, and invest in the former - taking their money out of the latter - we would see some automatic improvements in the system, and see them fairly quickly.

Rip Van Winkle would be the ideal stock market investor: Rip could invest in the market before his nap and when he woke up 20 years later, he'd be happy. He would have been asleep through all the ups and downs in between. But few investors resemble Mr. Van Winkle. The more often an investor counts his money - or looks at the value of his mutual funds in the newspaper - the lower his risk tolerance.

There is the general belief that the corporation income tax is a tax on the "rich" and on the "fat cats." But with pension funds owning 30% of American large business-and soon to own 50%-the corporation income tax, in effect, eases the load on those in top income brackets and penalizes the beneficiaries of pension funds.

The stock market has gone up and if you are stock picking, that's fine, you may do a bit better than the market. But if you want to play in another game where you can get rapid increases of value and so on and so forth, this apparently has become the new parlour game, to invest in these companies and many their cases, the private equity that has been piling in onto of the venture capital is creating the unicorn, in other words the company with the $1 billion valuation.