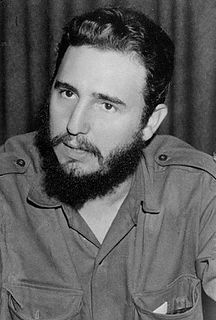

A Quote by Fidel Castro

A smart policy should be one that tends to receive the capitals, pays the price for that capital - which is the interest - returns the capital and in the end the factories, the industries, are left to remain in the country.

Related Quotes

If surface water can be compared with interest income, and non-renewable groundwater with capital, then much of the West was living mainly on interest income. California was milking interest and capital in about equal proportion. The plains states, however, were devouring capital as a gang of spendthrift heirs might squander a great capitalist's fortune.

I shall argue that it is the capital stock from which we derive satisfaction, not from the additions to it (production) or the subtractions from it (consumption): that consumption, far from being a desideratum, is a deplorable property of the capital stock which necessitates the equally deplorable activity of production: and that the objective of economic policy should not be to maximize consumption or production, but rather to minimize it, i.e. to enable us to maintain our capital stock with as little consumption or production as possible.

Throughout the industrial era, economists considered manufactured capital - money, factories, etc. - the principal factor in industrial production, and perceived natural capital as a marginal contributor. The exclusion of natural capital from balance sheets was an understandable omission. There was so much of it, it didn't seem worth counting.

Remember that accumulated knowledge, like accumulated capital, increases at compound interest: but it differs from the accumulation of capital in this; that the increase of knowledge produces a more rapid rate of progress, whilst the accumulation of capital leads to a lower rate of interest. Capital thus checks it own accumulation: knowledge thus accelerates its own advance. Each generation, therefore, to deserve comparison with its predecessor, is bound to add much more largely to the common stock than that which it immediately succeeds.

The financial doctrines so zealously followed by American companies might help optimize capital when it is scarce. But capital is abundant. If we are to see our economy really grow, we need to encourage migratory capital to become productive capital - capital invested for the long-term in empowering innovations.