A Quote by Frans van Houten

Price erosion in components is quite fast. If you can capitalize on that by bringing products to the market faster, you will actually gain a better margin realization.

Related Quotes

Edge also implies what Ben Graham....called a margin of safety. You have a margin of safety when you buy an asset at a price that is substantially less than its value. As Graham noted, the margin of safety 'is available for absorbing the effect of miscalculations or worse than average luck.' ...Graham expands, "The margin of safety is always dependent on the price paid. It will be large at one price, small at some higher price, nonexistent at some still higher price."

Shifting Philip Morris to the new a non-risk products doesn't mean that I will give market share to my competitors free of charge. In the markets where we are not present with IQOS yet or the other reduced-risk products, you still need to defend your share of the market. They still represent the bulk of our income, and so far they have financed the billions of dollars we have put behind these new products. But once we go national in a market, and absent capacity constraints, then you shift your resources and your focus to these new products.

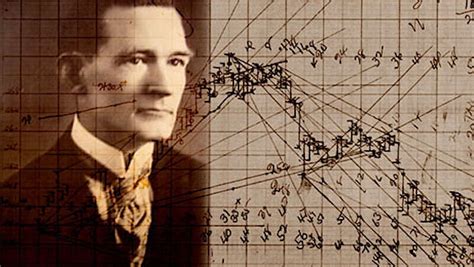

Time is the most important factor in determining market movements and by studying past price records you will be able to prove to yourself history does repeat and by knowing the past you can tell the future. There is a definite relation between price and time. By studying time cycles and time periods you will learn why market tops and bottoms are found at certain times, and why resistance levels are so strong at certain times, and prices hold around them. The most money is made when fast moves and extreme fluctuations occur at the end of major cycles.