A Quote by Gail Collins

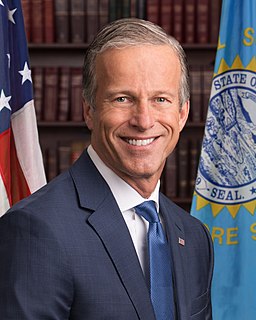

I don't think the folks in the low-tax states really want to go into a fairness discussion. Residents of Connecticut and New York would love to remind them how much they pay in federal taxes to support programs for Mississippi and South Dakota.

Related Quotes

The most absurd public opinion polls are those on taxes. Now, if there is one thing we know about taxes, it is that people do not want to pay them. If they wanted to pay them, there would be no need for taxes. People would gladly figure out how much of their money that the government deserves and send it in. And yet we routinely hear about opinion polls that reveal that the public likes the tax level as it is and might even like it higher. Next they will tell us that the public thinks the crime rate is too low, or that the American people would really like to be in more auto accidents.

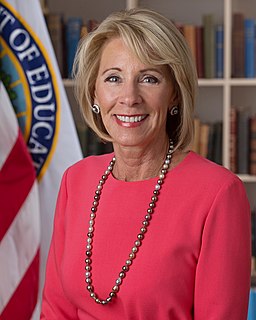

I thought you liberals cared about people, but here you're perfectly content to get them addicted to tobacco and make them pay taxes through the nose and continue to pay taxes through the nose and raise their taxes. And then you try to make 'em think you care about 'em by running PSAs telling them how they shouldn't smoke and how they should quit. You're exactly right. If they really cared, they would ban the product, but they can't, because the revenue from tobacco taxes - I'm not kidding you - funds children's health care programs, and a number of other things as well.

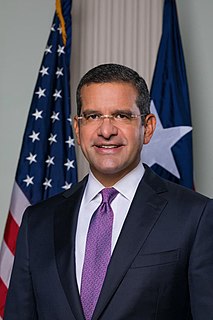

I support both a Fair Tax and a Flat Tax plan that would dramatically streamline the tax system. A Fair Tax would replace all federal taxes on personal and corporate income with a single national tax on retail sales, while a Flat Tax would apply the same tax rate to all income with few if any deductions or exemptions.

Liberals believe that crime is inextricably linked with poverty. In reality, most poor people never resort to crime, and some wealthy people commit evil acts to enrich themselves further. Harlem, East Los Angeles, the South side of Chicago are not the poorest communities in the United States. According to a new U.S. Bureau of the Census report, the poorest communities are Shannon County, South Dakota, followed by Starr, Texas, and Tunica, Mississippi. Have you ever heard of these residents rioting to protest their living conditions?

We should balance the budget. If government programs are important enough, we need to pay for them with taxes or make cuts in lesser programs. We've lost that discipline entirely. It seems prudent to avoid the possibility that the people who own our debt will start to worry the U.S. won't pay. That would raise how much it would cost the U.S. to borrow, which in a national emergency, like a war or pandemic, could be critical.

Not only are we going to New Hampshire ... we're going to South Carolina and Oklahoma and Arizona and North Dakota and New Mexico, and we're going to California and Texas and New York! And we're going to South Dakota and Oregon and Washington and Michigan. And then we're going to Washington, D.C. to take back the White House, Yeeeeeaaaaaargh!

When you say the tax system benefits the rich, there are a lot of people who respond, "That can't be true, look at the rate of tax. The people who are rich pay a higher rate than you or I." Well, yeah, but if you don't have to pay taxes on a lot of your income, then your real tax rate is a lot lower. And if you're allowed to pay your taxes thirty years from now instead of today then you're a lot better off. People need to have a sophisticated understanding of how the system works to appreciate that the posted tax rate really has very little to do with the taxes people pay.

It is easier to start taxes than to stop them. A tax an inch long can easily become a yard long. That has been the history of the income tax. Would not the sales tax be likely to have a similar history [in the U.S.]? ... Canadian newspapers report that an increase in the sales tax threatens to drive the Mackenzie King administration out of office. Canada began with a sales tax of 2%.... Starting this month the tax is 6%. The burden, in other words, has already been increased 200% ... What the U.S. needs is not new taxes, is not more taxes, but fewer and lower taxes.

You take the huge income that comes with a big gas tax, and you use it to pay off regressive taxes like the FICA [Federal Insurance Contributions Act] tax. You can help the poor in other ways besides giving them cheap gas. You want to send the message that people want to be as efficient as possible using gasoline until we can transition away from that need entirely.