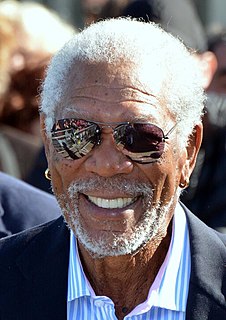

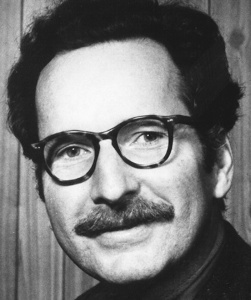

A Quote by Gene Perret

I'm now as free as the breeze - with roughly the same income.

Related Quotes

Oh there is blessing in this gentle breeze, A visitant that while it fans my cheek Doth seem half-conscious of the joy it brings From the green fields, and from yon azure sky. Whate'er its mission, the soft breeze can come To none more grateful than to me; escaped From the vast city, where I long had pined A discontented sojourner: now free, Free as a bird to settle where I will.

A summer breeze can be very refreshing; but if we try to put it in a tin can so we can have it entirely to ourselves, the breeze will die. Our beloved is the same. He is like a breeze, a cloud, a flower. If you imprison him in a tin can, he will die. Yet many people do just that. They rob their loved one of his liberty, until he can no longer be himself. They live to satisfy themselves and use their loved one to help them fulfill that. That is not loving; it is destroying.

The party should stand for a constantly wider diffusion of property. That is the greatest social and economic security that can come to free men. It makes free men. We want a nation of proprietors, not a state of collectivists. That is attained by creating a national wealth and income, not by destroying it. The income and estate taxes create an orderly movement to diffuse swollen fortunes more effectively than all the quacks.

The people who are having the hard time right now are middle-income Americans. Under the president's policies, middle-income Americans have been buried. They're just being crushed. Middle-income Americans have seen their income come down by $4,300. This is a tax in and of itself. I'll call it the economy tax. It's been crushing.

The standard of 'affordable' housing is that which costs roughly 30 percent or less of a family's income. Because of rising housing costs and stagnant wages, slightly more than half of all poor renting families in the country spend more than 50 percent of their income on housing costs, and at least one in four spends more than 70 percent.