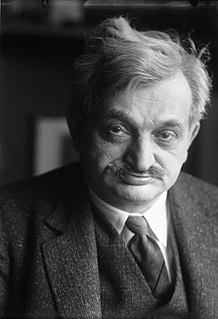

A Quote by George Soros

Fundamental analysis seeks to establish how underlying values are reflected in stock prices, whereas the theory of reflexivity shows how stock prices can influence underlying values

Related Quotes

The underlying strategy of the Fed is to tell people, "Do you want your money to lose value in the bank, or do you want to put it in the stock market?" They're trying to push money into the stock market, into hedge funds, to temporarily bid up prices. Then, all of a sudden, the Fed can raise interest rates, let the stock market prices collapse and the people will lose even more in the stock market than they would have by the negative interest rates in the bank. So it's a pro-Wall Street financial engineering gimmick.

Stock prices are likely to be among the prices that are relatively vulnerable to purely social movements because there is no accepted theory by which to understand the worth of stocks....investors have no model or at best a very incomplete model of behavior of prices, dividend, or earnings, of speculative assets.

People are, by and large, quite poor at judging correct absolute values but are astute about determining relative values. Psychologists call this coherent arbitrariness, which suggests that individuals are coherent when they compare prices on a relative basis but arbitrary when those prices are considered versus fundamental value.

If you expect to be a net saver during the next 5 years, should you hope for a higher or lower stock market during that period? Many investors get this one wrong. Even though they are going to be net buyers of stocks for many years to come, they are elated when stock prices rise and depressed when they fall. This reaction makes no sense. Only those who will be sellers of equities in the near future should be happy at seeing stocks rise. Prospective purchasers should much prefer sinking prices.