A Quote by Gerry Schwartz

I have said many times that it's a mistake to bet against the long-term health of the U.S. equity markets because it's a mistake to bet against the long-term health of the U.S. economy.

Related Quotes

Being captive to quarterly earnings isn't consistent with long-term value creation. This pressure and the short term focus of equity markets make it difficult for a public company to invest for long-term success, and tend to force company leaders to sacrifice long-term results to protect current earnings.

The most important thing that a company can do in the midst of this economic turmoil is to not lose sight of the long-term perspective. Don't confuse the short-term crises with the long-term trends. Amidst all of these short-term change are some fundamental structural transformations happening in the economy, and the best way to stay in business is to not allow the short-term distractions to cause you to ignore what is happening in the long term.

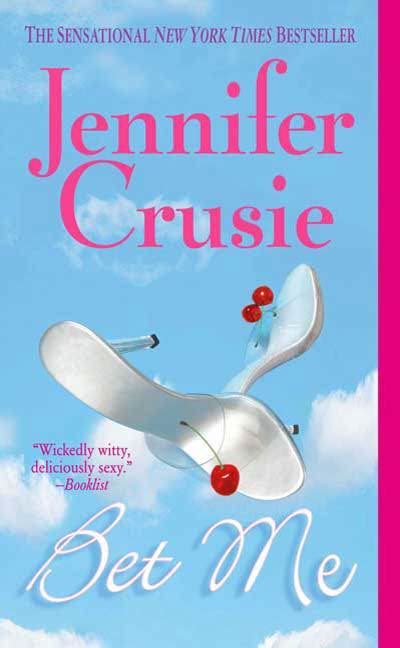

Bet you ten bucks we make it." What are the odds? she thought, and realized with sudden, blinding clarity that she wouldn't take the other side of that bet, that only a loser would bet against them. This is really it, she thought, amazed. This is really forever. I believe in this. "Min?" he said, and she kissed him, putting all her heart into it. "No bet," she said against his mouth. "Your odds are too good." "Our odds are too good

Our society does reward beauty on the outside over health on the inside. Women must not be blamed for choosing short-term beauty "fixes" that harm our long-term health, since our life spans are inverted under the beauty myth, and there is no great social or economic incentive for women to live a long time.

There were times in my life when I said, "Oh God, I'm making a terrible, terrible mistake here." And on another level it looked as if that's exactly what I had done. All of us can look back across our lives and see what we thought was a disaster was actually a blessing - from a long-term perspective, it was a blessing. With practice, we can shorten the length of time between "what a dumb mistake I've made" and "what a brilliant choice that was.

Long-term travel isn’t about being a college student; it’s about being a student of daily life. Long-term travel isn’t an act of rebellion against society; it’s an act of common sense within society. Long-term travel doesn’t require a massive “bundle of cash”; it requires only that we walk through the world in a more deliberate way.