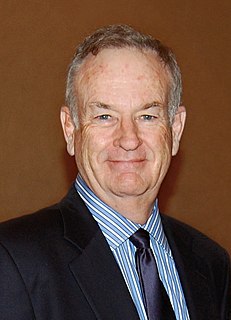

A Quote by Glenn Hubbard

The Obama administration's attempted short-term fixes, even with unprecedented monetary easing by the Federal Reserve, produced average GDP growth of just 2.2% over the past three years, and the consensus outlook appears no better for the year ahead.

Related Quotes

The Canadian debt-to-GDP ratio will continue to decrease every year, including the first three years under the Liberal government. That is what we're focused on. We know we need to invest in the kind of long-term growth and short-term job creation that Canadians expect, and Liberals the only party offering to do that.

In response to the recession, the Obama administration chose to emphasize costly, short-term fixes - ineffective stimulus programs, myriad housing programs that went nowhere, and a rush to invest in 'green' companies. As a consequence, uncertainty over policy - particularly over tax and regulatory policy - slowed the recovery.

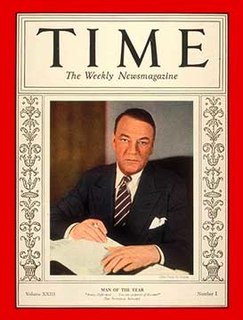

Transparency concerning the Federal Reserve's conduct of monetary policy is desirable because better public understanding enhances the effectiveness of policy. More important, however, is that transparent communications reflect the Federal Reserve's commitment to accountability within our democratic system of government.

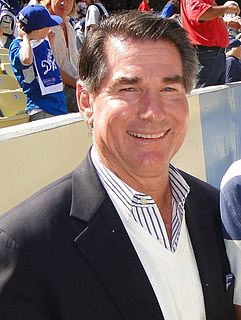

In a clean break from the Obama years, and frankly from the years before this president, we will keep federal spending at 20 percent of GDP, or less. That is enough. The choice is whether to put hard limits on economic growth, or hard limits on the size of government, and we choose to limit government.