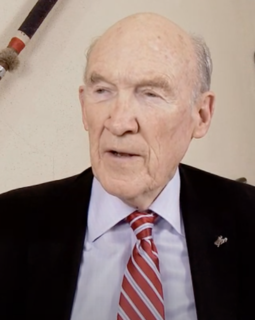

A Quote by Glenn Hubbard

President Obama has ignored or dismissed proposals that would address our anti-competitive tax code and unsustainable trajectory of federal debt - including his own bipartisan National Commission on Fiscal Responsibility and Reform - and submitted no plan for entitlement reform.

Related Quotes

Now, the president would like to do tax reform, which would obviously lower rates for most people in America and make the tax code fair and get rid of loopholes and special treatment. But absent tax reform, the president believes the right way to get our fiscal house in order is ask the wealthy to pay their fair share.

I took office as president in January 2003, and in April 2003, I sent to Congress my first proposal for tax reform. Some parts were voted on, with respect to federal taxes, and then it came to a standstill. Why? Because each state is interested in its own tax reform, has its own tax policy, and each state has its federal deputies and senators.

Obama seemed poised to realign American politics after his stunning 2008 victory. But the economy remains worse than even the administration's worst-case scenarios, and the long legislative battles over health care reform, financial services reform and the national debt and deficit have taken their toll. Obama no longer looks invincible.

In order to truly get deficit spending and federal debt under control, the Trump administration is going to have to eventually address entitlement reform. If not, Trump will not only become part of the Washington status quo on the issue, but will leave burdensome and expensive problems for future generations.

As Congress debates overhauling the nation's health care system, it should not authorize a reform plan that would further our financial woes. We must avoid creating an unsustainable government program. There is no question that reform is needed, but health care can be made more affordable without massive and expensive new bureaucracies.

We need to enact fundamental tax reform. The weight and complexity of our 73,000-page tax code are crushing everyday Americans. We need to radically simplify the tax code so that we can re-start the real engine of growth in our economy. That means our tax code needs to go from 73,000 pages down to about three pages.

We pursued the wrong policies. George Bush is not on the ballot. Bill Clinton is not on the ballot. Mitt Romney is on the ballot, and Barack Obama is on the ballot. And Mitt Romney is proposing tax reform, regulatory reform, a wise budget strategy and trade. The president has proposed tax increases.