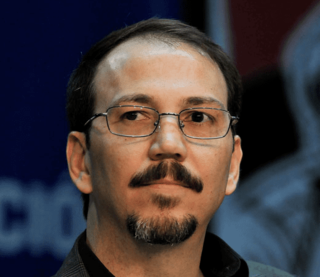

A Quote by Harry Browne

The income tax is the biggest single intrusion suffered by the American people. It forces every worker to be a bookkeeper, to open his records to the government, to explain his expenses, to fear conviction for a harmless accounting error. Compliance wastes billions of dollars. It penalizes savings and creates an enormous drag on the U.S. economy. It is incompatible with a free society, and we aren’t libertarians if we tolerate it.

Quote Topics

Accounting

American

American People

Biggest

Billions

Billions Of Dollars

Compliance

Conviction

Creates

Dollars

Drag

Economy

Enormous

Error

Every

Expenses

Explain

Fear

Forces

Free

Free Society

Government

Harmless

His

His Ex

Income

Income Tax

Incompatible

Intrusion

Libertarians

Open

People

Records

Savings

Single

Society

Suffered

Tax

Tolerate

Worker

Related Quotes

The United States is the most indebted country in the world. It has almost 17 billion dollars of debt with the rest of the world while living off the world's savings. They are living off the savings of the people of Greece, the savings of the people of Spain, France etc. All of those countries that save their reserves in the banks in dollars are simply financing the American economy, and that is why the average American citizen consumes two and a half times more than their income.

There is the general belief that the corporation income tax is a tax on the "rich" and on the "fat cats." But with pension funds owning 30% of American large business-and soon to own 50%-the corporation income tax, in effect, eases the load on those in top income brackets and penalizes the beneficiaries of pension funds.

When two working people decide to marry, their federal income tax is usually increased. As soon as one spouse earns at least 20 percent of a married couple's total income, the couple pays a 'marriage tax.' ... The United States is the only major industrialized nation in the free world in which the tax cost of the second [married] earner's entry into the work force is higher than that of the first. On one hand, our government's social policy is to help working women earn equal salaries to those of men, but on the other we have a tax structure that penalizes them when they do so.

The American business man cannot consider his work done when he views the income balance in black at the end of an accounting period. It is necessary for him to trace the social incidence of the figures that appear in his statement and prove to the general public that his management has not only been profitable in the accounting sense but salutary in terms of popular benefits.

There are 11 states in the United States that in the last 50 years instituted an income tax. So I looked at each of those 11 states over the last 50 years, and I took their current economic metrics and their metrics for the five years before they put in the progressive income tax... Every single state that introduced a progressive income tax has declined as an overall share of the U.S. economy.

This is all about creating good jobs for middle-income Americans, and it's a place where the President, frankly, has failed. His effort to put in place a series of liberal proposals he thought were historic kept his eye off the ball of getting the economy going again. It is the economy, and the American people aren't stupid. They want someone who can get this economy going again.

Let's talk about how to fill out your 1984 tax return. Here's an often overlooked accounting technique that can save you thousands of dollars: For several days before you put it in the mail, carry your tax return around under your armpit. No IRS agent is going to want to spend hours poring over a sweat-stained document. So even if you owe money, you can put in for an enormous refund and the agent will probably give it to you, just to avoid an audit. What does he care? It's not his money.