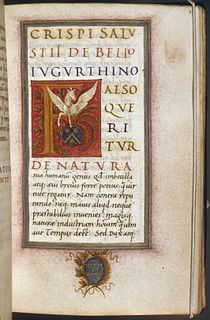

Ein Zitat von Howard Zinn

Seien wir einer historischen Wahrheit ins Auge: Wir hatten nie einen „freien Markt“, wir hatten immer staatliche Eingriffe in die Wirtschaft, und tatsächlich wurden diese Eingriffe von den Finanz- und Industriekapitänen begrüßt. Sie hatten nichts gegen die „große Regierung“, wenn diese ihren Bedürfnissen diente.

Verwandte Zitate

Der Erfolg der FHA ist ein starker Beweis dafür, dass die Regierung eine Rolle im Hypothekenfinanzierungssystem des Landes spielen kann und sollte. Es zeigt auch, dass staatliche Eingriffe in die Wirtschaft während der Großen Rezession zwar chaotisch waren, die Dinge aber ohne sie noch viel chaotischer gewesen wären.

Manchmal sagen die Leute zu mir: „Was war der Unterschied zwischen dem Kosovo, das eine erfolgreiche Intervention war, und dem Irak und Afghanistan, die so schwierig waren?“ Und die Antwort ist ganz einfach. Im Kosovo gab es nach der Beseitigung des Sturzes seines Regimes einen Prozess des politischen und wirtschaftlichen Wiederaufbaus, der ohne die Intervention des Terrorismus verlief. Wenn der Terrorismus eingegriffen hätte, wäre es dort übrigens extrem schwierig gewesen – aber wir haben es nicht getan.

Wenn beispielsweise bestehende staatliche Eingriffe geringfügig sind, werden wir der negativen Wirkung zusätzlicher staatlicher Eingriffe ein geringeres Gewicht beimessen. Dies ist ein wichtiger Grund, warum viele frühere Liberale, wie Henry Simons, der zu einer Zeit schrieb, als die Regierung nach heutigen Maßstäben klein war, bereit waren, von der Regierung Aktivitäten durchführen zu lassen, die die heutigen Liberalen jetzt, wo die Regierung so überwuchert ist, nicht akzeptieren würden.

Nach dem Bürgerkrieg kontrollierten die Republikaner jahrzehntelang die Bundesregierung und ihre Politik steigerte den Reichtum – mit verheerenden Folgen. Im Jahr 1893 brach die Wirtschaft zusammen und zu wenige Amerikaner verfügten über genügend Kaufkraft, um sie wiederzubeleben. Lincoln hatte recht gehabt: Eine Regierung, die den Reichen dient, würde das Land ruinieren.

Es besteht immer noch die Tendenz, jede bestehende staatliche Intervention als wünschenswert zu betrachten, alle Übel dem Markt zuzuschreiben und neue Vorschläge zur staatlichen Kontrolle in ihrer idealen Form zu bewerten, als ob sie funktionieren könnten, wenn sie von fähigen, desinteressierten Männern ohne jeglichen Druck umgesetzt würden von speziellen Interessengruppen.

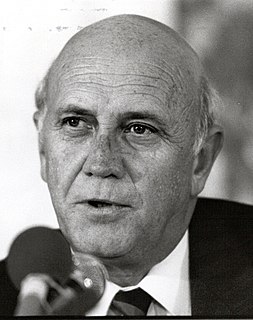

Während der sozialistischen Zeit wurde die Regierung zu groß. Das führte zu einem Verdrängungseffekt in der Privatwirtschaft und führte dazu, dass jeder mehr Steuern zahlen musste, um diese große Regierung zu finanzieren. Wir sind gegen eine große Regierung. Wir wollen eine kleinere und effizientere Regierung.

Es ist in Mode gekommen, gegen staatliche Eingriffe in die Wirtschaft zu schimpfen, und die FHA ist ein beliebtes Beispiel derjenigen, die versuchen, die Übermacht der Regierung aufzuzeigen. In Wirklichkeit zeigt die FHA, wie staatliche Maßnahmen während der Großen Rezession ein viel schlimmeres wirtschaftliches Schicksal verhindern konnten.

Regierungsplanung scheitert nicht nur; Es führt tendenziell zu Ergebnissen, die das Gegenteil von dem sind, was seine Befürworter angeblich befürworten. Das einzige stabile und produktive Gesellschaftssystem ist eines, das die menschliche Freiheit in ihrer Gesamtheit umfasst und die Marktwirtschaft, Privateigentum, gesundes Geld und friedliche internationale Beziehungen verteidigt, während es sich gegen staatliche Eingriffe als wirtschaftlich und sozial destruktiv wendet.