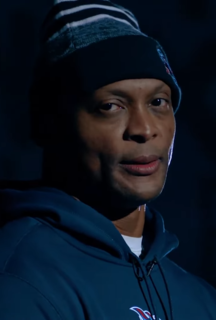

A Quote by James Grant

To me the gold price takes the form of a very uncomplicated formula, and all you have to do is divide one by 'n.' And 'n', I'm glad you ask, 'n' is the world's trust in the institution of paper money and in the capacity of people like Ben Bernanke to manage it. So the smaller 'n', the bigger the price. One divided by a receding number is the definition of a bull market.

Related Quotes

We looked into the abyss if the gold price rose further. A further rise would have taken down one or several trading houses, which might have taken down all the rest in their wake. Therefore at any price, at any cost, the central banks had to quell the gold price, manage it. It was very difficult to get the gold price under control but we have now succeeded. The US Fed was very active in getting the gold price down. So was the U.K.

Value in relation to price, not price alone, must determine your investment decisions. If you look to Mr Market as a creator of investment opportunities (where price departs from underlying value), you have the makings of a value investor. If you insist on looking to Mr Market for investment guidance however, you are probably best advised to hire someone else to manage your money.

When you own gold you're fighting every central bank in the world. That's because gold is a currency that competes with government currencies and has a powerful influence on interest rates and the price of government bonds. And that's why central banks long have tried to suppress the price of gold. Gold is the ticket out of the central banking system, the escape from coercive central bank and government power.

If you increase the number of rockets you build and you buy, then it's the scale of the economy, the price is going to come down. It may not come down in order of magnitude, but if several commercial ventures start being successful and there becomes a bigger market for these rockets, the price will naturally come down a bit. That's why I think Excalibur Almaz, we're a little bit unique in that we don't look at our so-called competition with disdain, we want them to succeed and it needs to have more than one player. Even if we are successful, we couldn't handle the entire market ourselves.

The problem right now is that central banks have not normalized their balance sheet since 2009. They're trying, but it's not even close. If we had another crisis tomorrow, and you had to do QE4 and QE5, how could you do that when you're already at $4 trillion? They might have to turn to the IMF or SDR or to Gold. Then, if you go back to the gold standard, you have to get the price right. People say there's not enough gold to support a gold standard. That's nonsense. There's always enough gold, it's just a question of price.