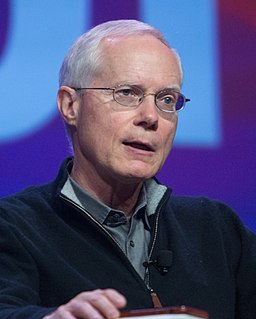

A Quote by Jason Hartman

How many millionaires do you know who have become wealthy by investing in stocks, bonds, mutual funds or savings accounts? Income property is the most historically proven asset class in America, if not the entire world. I rest my case.

Related Quotes

The business side of real estate investing is fraught with risk. Unlike purchasing mutual funds or savings bonds, with real estate, you can lose money; this is one of the reasons that seasoned real estate investors caution neophytes never to get too emotional about a property and always be willing to walk away.

For all your long-term investments, such as retirement accounts that you won't touch for at least ten years, you need a mix of stocks and bonds. Stocks offer the best shot at inflation-beating gains. But stocks don't always go up. That's where bonds come into play: They have less upside potential, but they also do not pack the same risk.

They talk about class warfare -- the fact of the matter is there has been class warfare for the last thirty years. It's a handful of billionaires taking on the entire middle-class and working-class of this country. And the result is you now have in America the most unequal distribution of wealth and income of any major country on Earth and the worst inequality in America since 1928. How could anybody defend the top 400 richest people in this country owning more wealth than the bottom half of America, 150 million people?

Of course, giving is deeply emotional. But supplementing emotion with research makes it more likely that a gift can have a bigger impact. It's like any investment. After all, you wouldn't put funds into stocks or bonds without understanding the potential return. Why wouldn't you do the same when investing in society?