A Quote by Jean Chatzky

The Bankruptcy Reform Act of 2005 made it harder for individuals to file bankruptcy, which is always the last resort. Unfortunately, simultaneously consumers racked up so much debt that counseling companies - which are higher up on my list if you need help managing your debt - are sometimes unable to help. So if you fall into this camp, debt settlement may be something to consider.

Quote Topics

Related Quotes

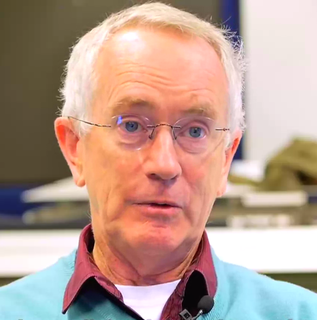

Debt is a trap, especially student debt, which is enormous, far larger than credit card debt. It's a trap for the rest of your life because the laws are designed so that you can't get out of it. If a business, say, gets in too much debt, it can declare bankruptcy, but individuals can almost never be relieved of student debt through bankruptcy.

Debt is a trap, especially student debt, which is enormous, far larger than credit card debt. It’s a trap for the rest of your life because the laws are designed so that you can’t get out of it. If a business, say, gets in too much debt it can declare bankruptcy, but individuals can almost never be relieved of student debt through bankruptcy.

Once the settlement is completed, the credit card company will report it to the credit bureaus, which will then make a notation on your credit report that that account was paid by settlement. That's going to signal to future lenders that you left the last guy hanging. That's why, as with bankruptcy, debt settlement is an extreme option, one you shouldn't take lightly. It's not just an easy, cheap way to eliminate debt.

Debt settlement companies work as a middleman between you and your creditor. If all goes well (and that's a big if), you should be able to settle your debts for cents on the dollar. You'll also pay a fee to the debt settlement company, usually either a percentage of the total debt you have or a percentage of the total amount forgiven.

You settled a debt instead of paying in full will stay on your credit report for as long as the individual accounts are reported, which is typically seven years from the date that the account was settled. Unlike with bankruptcy, there isn't a separate line on your credit report dedicated to debt settlement, so each account settled will be listed as a charge-off.

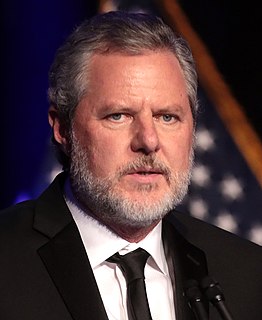

If you have a sane economy, and by sane economy I mean one which is not addicted to debt, not a Ponzi economy, then the change in debt each year should contribute a minor amount to demand. Therefore, if you tried to correlate debt to the level of unemployment you would not find much of a correlation. Unfortunately that is not the economy we live in.

People think of a business cycle, which is a boom followed by a recession and then automatic stabilizers revive the economy. But this time we can't revive. The reason is that every recovery since 1945 has begun with a higher, and higher level of debt. The debt is so high now, that since 2008 we've been in what I call, debt deflation.