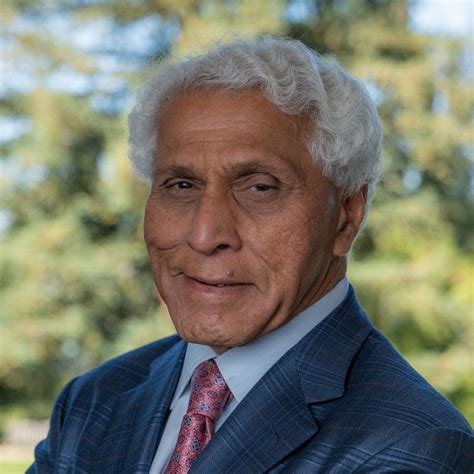

A Quote by J. J. Redick

I would much rather invest in stocks, bonds, private equity and hedge funds than watches.

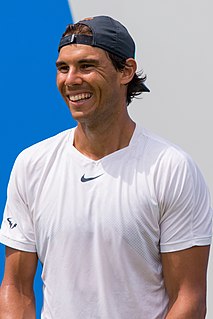

Related Quotes

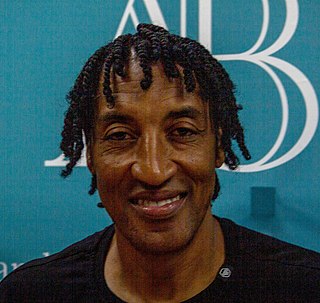

When I was 23, 24, I started covering hedge funds - a lot of this was luck - when no one else did. This was before hedge funds were the prettiest girl in school: this was pre-nose job and treadmill for hedge funds, when nobody talked to them - back then, it was just all about insurance companies and money managers.