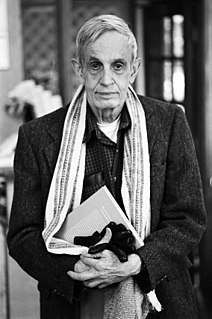

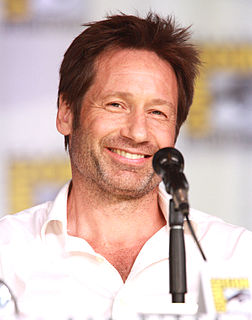

A Quote by John C. Bogle

I've been studying mutual funds since 1949, when I began researching my senior thesis at Princeton University.

Related Quotes

My high school career was undistinguished except for math and science. However, having barely been admitted to Rice University, I found that I enjoyed the courses and the elation of success and graduated with honors in physics. I did a senior thesis with C.F. Squire, building a regulator for a magnet for use in low-temperature physics.

At Princeton I wrote my junior paper on Virginia Woolf, and for my senior thesis I wrote on Samuel Beckett. I wrote some about "Between the Acts" and "Mrs. Dalloway'' but mostly about "To the Lighthouse." With Beckett I focused, perversely, on his novels, "Molloy," "Malone Dies," and "The Unnamable." That's when I decided I should never write again.

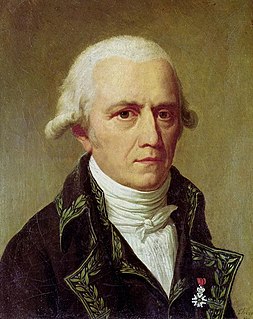

The thesis that the living creatures have always been composed different species was established in a time where no sufficient observations had been made and when science hardly existed. This thesis is denied every day by those who have made accurate observations, who have long time observed nature and who have had the benefit from studying our musei's large and rich collections.