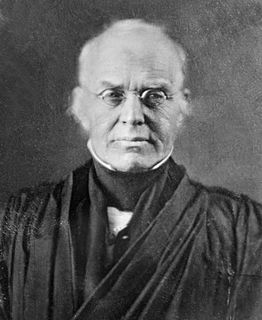

A Quote by Joseph Story

Related Quotes

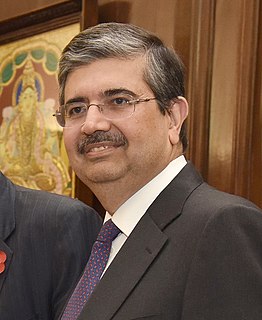

I'm struck by the fact that by and large equity capital doesn't play a big role in new financing; it's either bonds or internal financing but not really equity. And therefore, it's not clear that anything which improves the equity markets has really much to do with the productivity of the economy as a whole.

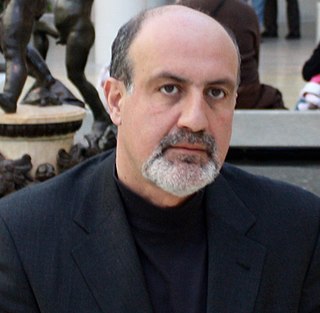

Equity is a roguish thing. For Law we have a measure, know what to trust to; Equity is according to the conscience of him that is Chancellor, and as that is larger or narrower, so is Equity. 'T is all one as if they should make the standard for the measure we call a "foot" a Chancellor's foot; what an uncertain measure would this be! One Chancellor has a long foot, another a short foot, a third an indifferent foot. 'T is the same thing in the Chancellor's conscience.

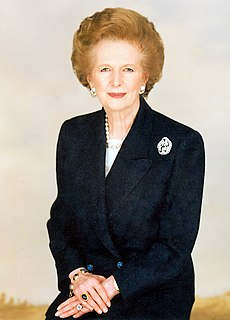

We weren't getting a fair deal on the budget and I wasn't going to have it. There's a great strand of equity and fairness in the British people - this is our characteristic. There's not a strand of equity and fairness in Europe - they're out to get as much as they can. That's one of those enormous differences. So I tackled it on that basis.