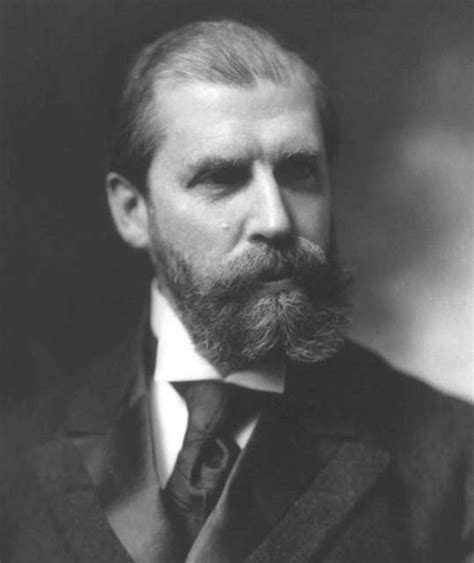

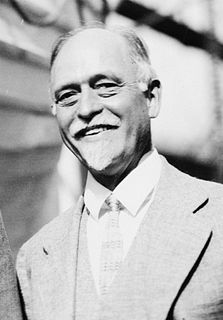

A Quote by Joseph Stiglitz

Negative interest rates hurt banks' balance sheets, with the 'wealth effect' on banks overwhelming the small increase in incentives to lend.

Related Quotes

One nation banking recognises that banks must not be isolated from the rest of the economy. Because banks and small businesses must succeed or fail together, banks must lend to small businesses so we can get the growth and jobs we need for the future. As things stand, that is not happening enough. Lending was down £10.8billion last year.

I passionately disagreed with Treasury Secretary Hank Paulson's plan to bail out the banks by using a public fund called the Troubled Asset Relief Program (TARP) to help banks take toxic assets off their balance sheets. I argued that it would be much better to put the money where the hole was and replenish the equity of the banks themselves.

The Fed has a lot of power in the economy because it has a big impact on the supply and cost of credit, that is, interest rates. It also plays a key role in supervising banks and historically has seemed to take it easy on the banks when it shouldn't have, such as in the lead up to the financial crisis.

Central banks are choosing to increase their gold holdings as a percentage of total reserves. They obviously think there is a reason to do that. It doesn't make sense to back up one currency with a hoard of other paper currencies. There needs to be a real anchor there. I think that central banks are well behind the curve. If you look at the percentage of above-ground gold controlled by central banks, it's historically low. Hence the fact that central banks are trying to increase their holdings. They've got a long way to go to get where they need to be.

A higher IOER rate encourages banks to raise the interest rates they charge, putting upward pressure on market interest rates regardless of the level of reserves in the banking sector. While adjusting the IOER rate is an effective way to move market interest rates when reserves are plentiful, federal funds have generally traded below this rate.

If two parties, instead of being a bank and an individual, were an individual and an individual, they could not inflate the circulating medium by a loan transaction, for the simple reason that the lender could not lend what he didn't have, as banks can do. Only commercial banks and trust companies can lend money that they manufacture by lending it.

What central banks can control is a base and one way they can control the base is via manipulating a particular interest rate, such as a Federal Funds rate, the overnight rate at which banks lend to one another. But they use that control to control what happens to the quantity of money. There is no disagreement.