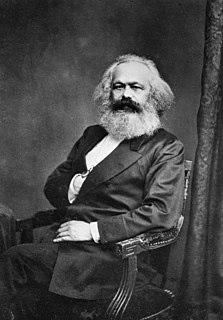

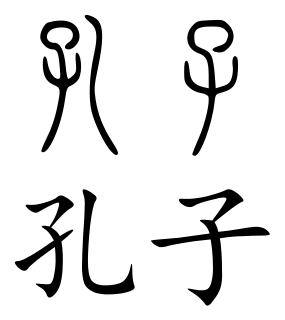

A Quote by Karl Marx

The aggregate capital appears as the capital stock of all individual capitalists combined. This joint stock company has in common with many other stock companies that everyone knows what he puts in, but not what he will get out of it.

Related Quotes

The stock market has gone up and if you are stock picking, that's fine, you may do a bit better than the market. But if you want to play in another game where you can get rapid increases of value and so on and so forth, this apparently has become the new parlour game, to invest in these companies and many their cases, the private equity that has been piling in onto of the venture capital is creating the unicorn, in other words the company with the $1 billion valuation.

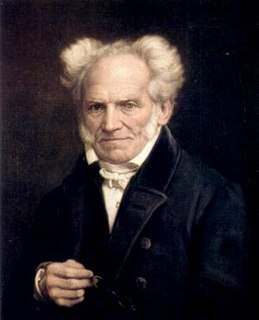

I shall argue that it is the capital stock from which we derive satisfaction, not from the additions to it (production) or the subtractions from it (consumption): that consumption, far from being a desideratum, is a deplorable property of the capital stock which necessitates the equally deplorable activity of production: and that the objective of economic policy should not be to maximize consumption or production, but rather to minimize it, i.e. to enable us to maintain our capital stock with as little consumption or production as possible.

Unfortunately our stock is somehow not well understood by the markets. The market compares us with generic companies. We need to look at Biocon as a bellwether stock. A stock that is differentiated, a stock that is focused on R&D, and a very-very strong balance sheet with huge value drivers at the end of it.

Unfortunately, our stock is somehow not well understood by the markets. The market compares us with generic companies. We need to look at Biocon as a bellwether stock. A stock that is differentiated, a stock that is focused on R&D, and a very, very strong balance sheet with huge value drivers at the end of it.

The other dynamic keeping the stock market up - both for technology stocks and others - is that companies are using a lot of their income for stock buybacks and to pay out higher dividends, not make new investment,. So to the extent that companies use financial engineering rather than industrial engineering to increase the price of their stock you're going to have a bubble. But it's not considered a bubble, because the government is behind it, and it hasn't burst yet.