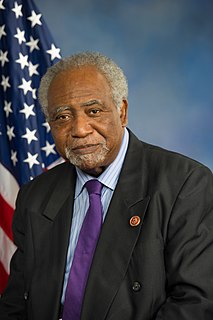

A Quote by Keith Ellison

You know, the elites always want to shame the poor - right? - and everyone else. I mean, the fact is, this economy is based on 70 percent of the people driving consumer demand. If people do not purchase goods and services, this economy will grind to recession. And that is why, if you are going to do a tax cut, it ought to really be aimed at low-income and middle-income people.

Related Quotes

The people who are having the hard time right now are middle-income Americans. Under the president's policies, middle-income Americans have been buried. They're just being crushed. Middle-income Americans have seen their income come down by $4,300. This is a tax in and of itself. I'll call it the economy tax. It's been crushing.

All taxes, except a 'lump-sum tax,' introduce distortions in the economy. But no government can impose a lump-sum tax - the same amount for everyone regardless of their income or expenditures - because it would fall heaviest on those with less income, and it would grind the poor, who might be unable to pay it at all.

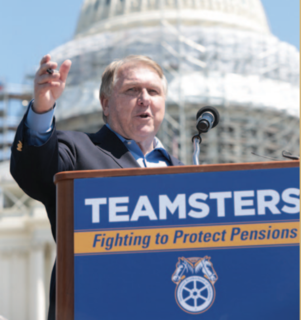

For the workers and their families, being able to bring home a living wage helps their families and, by extension, helps our economy. Seventy percent of our economy is consumer-based. We know that when lower- and middle-class families have money and disposable income, they spend it. That puts money back into the economy. It's a win-win for everybody: Not just for the individual, not just production at a specific company (like Nissan), but for the greater good.

So, what people are actually left with to spend is maybe 25 to 30% of their income on goods and services, after paying taxes and after paying the FIRE sector (Finance, Insurance, Real Estate). Whether it's housing insurance or mortgage insurance. So there's an idea of distracting people. Don't think of your condition. Think of how the overall economy is doing. But don't think of the economy as an overall unit. Think of the stock market as the economy. Think of the rich people as the economy. Look at the yachts that are made. Somebody's living a lot better. Couldn't it be you?

Regarding the Economy & Taxation: America's most successful achievers do pay a higher share of the total tax burden. The top one percent income earners paid 18 percent of the total tax burden in 1981, and paid 25 percent in 1991. The bottom 50 percent of income earners paid only 8 percent of the total tax burden, and paid only 5 percent in 1991. History shows that tax cuts have always resulted in improved economic growth producing more tax revenue in the treasury.

It makes no difference to a widow with her savings in a 5 percent passbook account whether she pays 100 percent income tax on her interest income during a period of zero inflation or pays no income tax during years of 5 percent inflation. Either way, she is 'taxed' in a manner that leaves her no real income whatsoever. Any money she spends comes right out of capital. She would find outrageous a 100 percent income tax but doesn't seem to notice that 5 percent inflation is the economic equivalent.

This is all about creating good jobs for middle-income Americans, and it's a place where the President, frankly, has failed. His effort to put in place a series of liberal proposals he thought were historic kept his eye off the ball of getting the economy going again. It is the economy, and the American people aren't stupid. They want someone who can get this economy going again.

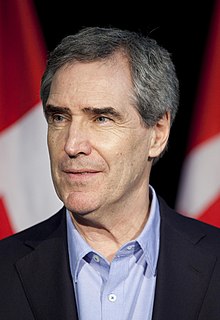

We can't afford to waste people. We can't afford to have people think the game is over before it's begun. We've got to be saying to the Canadian people: you can't tax cut your way to a productive 21st-century economy. You can talk that talk, but it's not going to give you a productive 21st-century economy, because it will scythe apart the public goods that make prosperity possible. That's what we've got to say, and so we shall.

In 1990, about 1 percent of American corporate profits were taken in tax havens like the Cayman Islands. By 2002, it was up to 17 percent, and it'll be up to 20-25 percent very quickly. It's a major problem. Fundamentally, we have a tax system designed for a national, industrial, wage economy, which is what we had in the early 1900s. We now live in a global, asset-based, services world. And we need to have a tax system that follows the economic order or it's going to interfere with economic growth, it's going to reduce people's incomes, and it's going to damage the US.