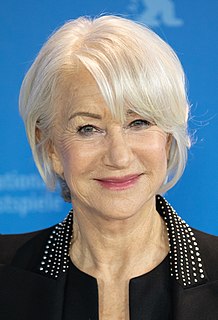

A Quote by Kelly Evans

The collapse of the housing bubble sent the world spiraling into recession. The collapse of the energy and commodity bubble threatens to be just as damaging.

Related Quotes

From the Great Depression, to the stagflation of the seventies, to the current economic crisis caused by the housing bubble, every economic downturn suffered by this country over the past century can be traced to Federal Reserve policy. The Fed has followed a consistent policy of flooding the economy with easy money, leading to a misallocation of resources and an artificial 'boom' followed by a recession or depression when the Fed-created bubble bursts.

The bottom line for housing is that the concerns we used to hear about the possibility of a devastating collapse—one that might be big enough to cause a recession in the U.S. economy—while not fully allayed have diminished. Moreover, while the future for housing activity remains uncertain, I think there is a reasonable chance that housing is in the process of stabilizing, which would mean that it would put a considerably smaller drag on the economy going forward.

Too-easy credit and millions of bad loans made during the U.S. housing bubble paved the way for the financial calamity and Great Recession that followed. Today, by contrast, credit is too tight. Mortgage loans are particularly hard to get, creating a problem for the housing market and the broader economy.

People at the top spend less money than those at the bottom so when you have redistribution toward the top, aggregate demand goes down. Unless you intervene, you're going to have a weak economy unless something else happens. That something else could be a bubble. The United States tried a tech bubble and a housing bubble, but those were not sustainable answers. So I view inequality as a fundamental part of our macroeconomic weakness.

I've not won different awards - many, many times - so luckily I've practiced that whenever you are nominated for anything, you enter into this marvelous, fantabulous bubble called the bubble of nomination. The minute the envelope is opened and your name isn't called out, the bubble bursts. And no one calls you up the next day to say, 'So sorry you didn't win,' or 'You looked gorgeous - nothing. If you win, you get about another 24 hours in that lovely bubble and then - pop - you are slightly wet all over from the bubble and realize that you have to get on with real life.