A Quote by Kevin Brady

I'm tired of seeing American jobs, manufacturing, and headquarters forced overseas due to a tax code that works against us.

Related Quotes

In the four decades after World War II, manufacturing jobs paid more than other jobs for given skills. But that is much less true today. Increased international competition has forced American manufacturers to reduce costs. As a result, the pay premium for low-skilled workers in manufacturing is smaller than it once was.

NAFTA, supported by the Secretary cost, us 800,000 jobs nationwide, tens of thousands of jobs in the Midwest. Permanent normal trade relations with China cost us millions of jobs. Look, I was on a picket line in early 1990's against NFATA because you didn't need a PhD in economics to understand that American workers should not be forced to compete against people in Mexico making 25 cents an hour.

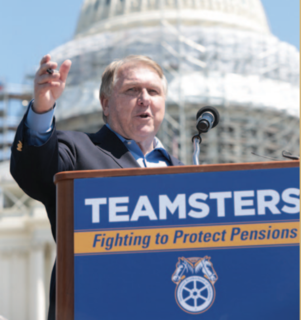

We've got a tax code that is encouraging flight of jobs and outsourcing. And that's why we've specifically recommended in this campaign that Congress change our tax code so that we stop giving tax breaks to companies that are moving to Mexico and China and other places, and start putting those tax breaks into companies that are investing here in the United States.

Astonishingly, American taxpayers now will be forced to finance a multi-billion dollar jobs program in Iraq. Suddenly the war is about jobs. We export our manufacturing jobs to Asia, and now we plan to export our welfare jobs to Iraq, all at the expense of the poor and the middle class here at home.

The tax that was supposed to soak the rich has instead soaked America. The beneficiary of the income tax has not been the poor, but big government. The income tax has given us a government bureaucracy that outnumbers the manufacturing work force. It has created welfare dependencies that have entrapped millions of Americans in an underclass that is forced to live a sordid existence of trading votes for government handouts.