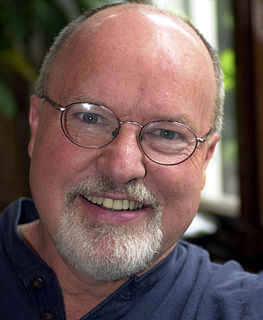

A Quote by Kevin O'Leary

I like gold because it is a stabilizer; it is an insurance policy.

Related Quotes

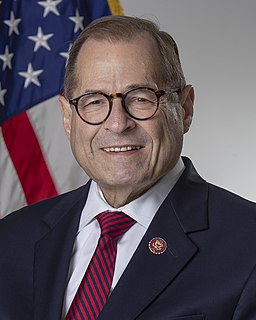

I can't remember the exact quote but when I used to trade and Mr. Volcker was Fed chairman, he said something like 'gold is my enemy, I'm always watching what gold is doing', we need to think why he made a statement like that. If you're a central banker or one of the congressmen or senators, watch what gold is doing because this is a no-confidence vote in fiscal and dollar policy.

My treasure chest is filled with gold.

Gold . . . gold . . . gold . . .

Vagabond's gold and drifter's gold . . .

Worthless, priceless, dreamer's gold . . .

Gold of the sunset . . . gold of the dawn . . .Gold of the showertrees on my lawn . . .

Poet's gold and artist's gold . . .

Gold that can not be bought or sold -

Gold.

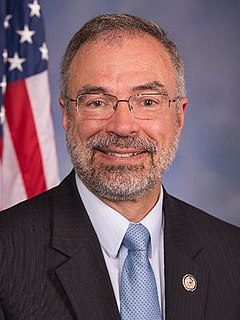

Kyoto costs a lot, does nothing to prevent calamity, and pays no compensation in the event of loss. If my insurance broker offered that sort of policy, I would not carry insurance. Instead what my broker offers is a policy that costs a little and pays full compensation in the event of loss. If someone wants to propose that as a policy on global warming, I'm all in favour.

The premise of insurance is to spread the risk. It's the premise of homeowner's insurance, of car insurance, and of health insurance. It's one reason why it's important to have insurance when you're healthy, so that when you get sick, you won't go sign up just when you get sick, because that increases the cost for everyone.

Insurance is meant for extraordinary circumstances. You don't use car insurance to pay for oil changes or gasoline; you have it as protection in case you have a terrible accident or your car is stolen. You don't use homeowners' insurance to pay your electricity and water bills; you have it as protection in case a fire or other catastrophic event produces a large expense. Obviously, any insurance policy that promises to cover every small, ordinary expense is going to be much more expensive than one that covers only extraordinary expenses.